seraficus/E+ via Getty Images

Welcome to the May edition of the graphite miners news.

May saw a busy month of news with plenty of good progress by the graphite juniors. On the political front we saw USA and Canada increase their efforts towards supporting the EV battery manufacturing and battery materials supply chains. We also heard more forecasts of battery and EV metals shortages ahead.

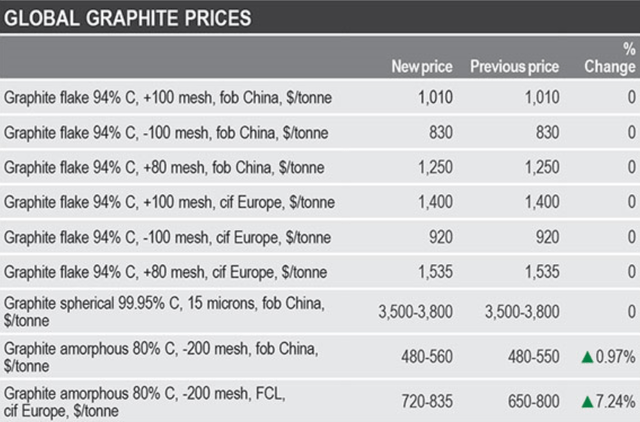

Graphite price news

During the past 30 days the China graphite flake-194 EXW spot price was flat (0.00%), and is up 21.7% over the past 360 days. Note that 94-97% is considered best suited for use in batteries; it is then upgraded to 99.9% purity to make “spherical” graphite used in Li-ion batteries. The spherical graphite 99.95% min EXW China price was up 0.68% the past 30 days.

Fastmarkets (see below) shows China graphite flake 94% C (-100 mesh) prices at US$830/t and Europe graphite flake 94% C (-100 mesh) prices at US$920/t.

Fastmarkets graphite prices the week ending May 12, 2022

Fastmarkets

Source: Fastmarkets

Note: You can read about the different types of graphite and their uses here.

In an April 25, 2021 report from Leading Edge Materials they stated:

A recent price assessment produced by Benchmark Mineral Intelligence for the Company shows average pricing in 2020 for uncoated natural spherical graphite at around US$3,000 per tonne and for coated natural spherical graphite between US$7,000 per tonne (domestic China and non-EU) and US$12,000 per tonne (high-end applications), with an average price of around US9,500 per tonne for material used in cells for Western OEMs…..

A reminder of a 2016 Elon Musk quote:

Our cells should be called Nickel-Graphite, because primarily the cathode is nickel and the anode side is graphite with silicon oxide.

Graphite demand and supply forecast charts

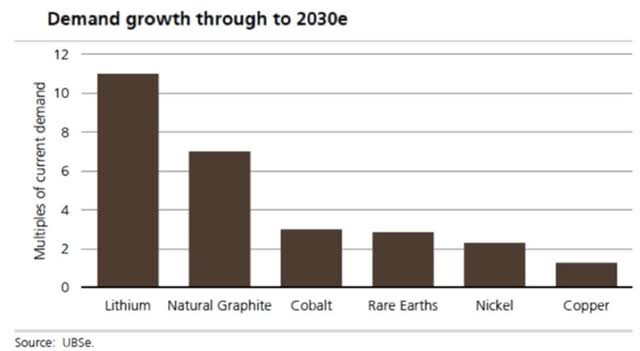

UBS’s EV metals demand forecast (from Nov. 2020)

UBS

Source: Mining.com courtesy UBS

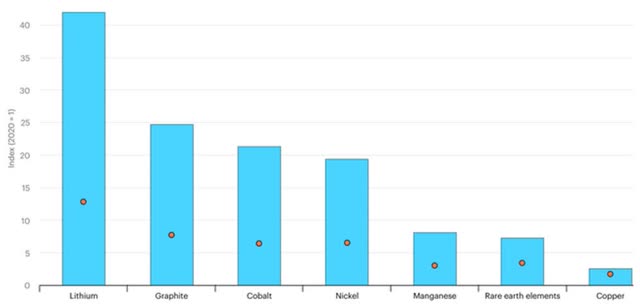

2021 IEA forecast growth in demand for selected minerals from clean energy technologies by scenario, 2040 relative to 2020 – Increases Of Lithium 13x to 42x, Graphite 8x to 25x, Cobalt 6x to 21x, Nickel 7x to 19x, Manganese 3x to 8x, Rare Earths 3x to 7x, And Copper 2x to 3x

IEA

Source: International Energy Agency 2021 report

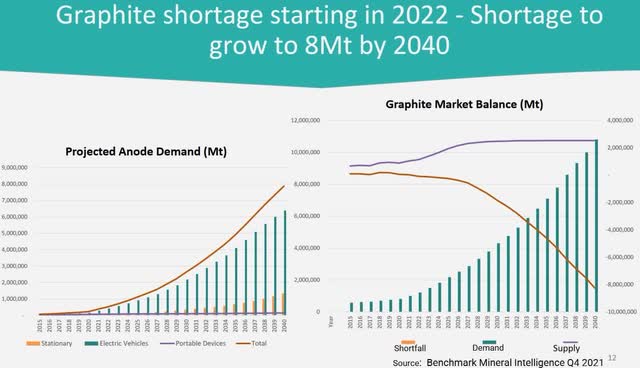

BMI forecasts graphite deficits to begin from 2022 as demand for graphite grows strongly

BMI

Source: Lomiko Metals company presentation courtesy Benchmark Mineral Intelligence

Graphite market news

An article I missed from last month, on April 10 the South China Morning Post reported:

Shortage of EV battery raw material graphite could delay global drive to go green…..While graphite deposits are not scarce, the supply of battery-grade graphite – used as a raw material in EV batteries – is much tighter…..Graphite, a critical mineral used in electric vehicle batteries, could see a shortage in supply amid surging demand for EVs, which may delay the global drive to go green……With electric vehicle sales expected to reach up to 11 million units in 2022, there could be a deficit of around 40,000 tonnes of graphite this year, said George Miller, an analyst from London-based battery materials data and intelligence provider Benchmark Mineral Intelligence in an interview.

On May 10 Bloomberg BNN reported:

Stellantis CEO says supply issues risk derailing electric shift…..The shift to EVs will work only if the region [Europe] ensures access to enough clean energy, batteries, raw materials and charging infrastructure…..

On May 12 Reuters reported:

Pentagon asks Congress to fund mining projects in Australia, U.K……that process strategic minerals used to make electric vehicles and weapons, calling the proposal crucial to national defense. The request to alter the Cold War-era Defense Production Act…..Congress may reject or accept the proposed changes when it finalizes the bill later this year…..Relying only on domestic or Canadian sources, the Pentagon said, “unnecessarily constrains” the DPA program’s ability to “ensure a robust industrial base.”

On May 18 Fastmarkets reported:

Flake graphite market softening on rising supplies, uncertainty, sources say. The strengthening of flake graphite prices since last September has eased with increasing volumes of supplies available following the restart of operations in China’s Heilongjiang province, although the Ukraine-Russia war and new Covid-19 outbreaks in China have added new uncertainties.

On May 25 Mining Weekly reported:

Severe global battery shortage likely post 2025, GlobalData forecasts. Extraction of raw materials will not meet soaring battery demand unless capital markets change course in the face of environmental, social and governance pressures and invest heavily in new mines, says business data and analytics company GlobalData in its ‘Batteries – Thematic Research’ report…….An emerging challenge for the next decade will be whether extraction of natural resources and raw materials such as lithium, nickel, cobalt and graphite can meet the soaring demand for batteries.

Graphite miners news

Graphite producers

I have not covered the following graphite producers as they are not typically accessible to most Western investors. They include – Aoyu Graphite Group, BTR New Energy Materials, Qingdao Black Dragon, National de Grafite, Shanshan Technology, and LuiMao Graphite.

Note: AMG Advanced Metallurgical Group NV [NA:AMG] [GR:ADG] (OTCPK:AMVMF) is also a “diversified producer”, producing graphite and lithium. SGL Carbon (ETR:SGL) (OTCPK:SGLFF) is a synthetic graphite producer and Novonix [ASX:NVX] (OTCQX:NVNXF) is commercializing their synthetic graphite product. Graphex Group Limited [HK:6128] (OTCQX:GRFXY) makes spherical graphite.

Syrah Resources Limited [ASX:SYR][GR:3S7]( OTCPK:SYAAF)(OTC:SRHYY)

Syrah Resources Limited owns the Balama graphite mine in Mozambique. Syrah is also working to become a vertically integrated producer of natural graphite Active Anode Material (“AAM”) at their Vidalia facility, Louisiana, USA.

On April 27, Syrah Resources announced: “Quarterly activities report – Period ended 31 March 2022.” Highlights include:

- “…..Demand growth for Balama natural graphite end uses, with global electric vehicle (“EV”) sales up 80% in Q1 2022, versus Q1 2021, to approximately 2.0 million units and Chinese anode production increasing to above 90kt in March 2022.

- Higher Balama production and sales enabled by Pemba breakbulk shipments supplementing Nacala container shipments.

- Balama produced 46kt natural graphite at 76% recovery with 35kt sold and shipped during quarter.

- Product quality consistent with previous quarters with stable grade, and higher recovery relative to historical quarters with an equivalent production rate.

- Balama C1 cash costs (FOB Nacala/Pemba) of US$464 per tonne.

- Weighted average sales price increased to US$573 per tonne (CIF), with very strong incremental demand and higher new contract prices.

- First 10kt spot breakbulk shipment from Pemba port arrived in China in March 2022 and two spot breakbulk shipments scheduled in the June 2022 quarter.

- Significant sales order book with more than 90kt of natural graphite sales orders for the June 2022 quarter and into the second half of 2022, demonstrating robust underlying demand conditions.

- Final investment decision for initial expansion of Vidalia AAM facility to 11.25ktpa AAM production capacity (“Vidalia Initial Expansion”) approved by Syrah Board.

- Detailed engineering for the Vidalia Initial Expansion project more than 60% completed and construction advancing within the planned schedule and budget.

- 11.25ktpa AAM Vidalia facility targeted to start production in the September 2023 quarter.

- BFS on the expansion of Vidalia’s production capacity to at least 45ktpa AAM, inclusive of 11.25ktpa AAM, to be completed in 2022.

-

Syrah completed A$250 million (US$178 million) institutional placement and pro rata accelerated non-renounceable entitlement offer to fully fund the Vidalia Initial Expansion project and strengthen balance sheet. - Syrah offered a Conditional Commitment6 from the US Department of Energy following finalisation of a non-binding term sheet for up to US$107 million loan to fund the Vidalia Initial Expansion.

- Quarter end cash balance of US$205 million.“

You can view the latest investor presentation here.

Catalysts:

- September 2023 quarter – 11.25ktpa AAM Vidalia facility targeted to start production.

Ceylon Graphite [TSXV:CYL] [GR:CCY] (OTC:CYLYF)

Ceylon Graphite has ‘Vein graphite’ production out of one mine in Sri Lanka with 121 square kilometers of tenements.

On May 13, Ceylon Graphite announced: “Ceylon Graphite closes upsized $3,500,000 private placement and extension of debentures…..”

Mineral Commodities Ltd. (“MRC”) [ASX:MRC]

Skaland Graphite is 90% owned by MRC. Skaland is the highest grade flake graphite operation in the world and largest producing mine in Europe; with immediate European graphite production of up to 10,000 tonnes per annum with regulatory approval to increase to 16,000. MRC plans to demerge its Norwegian graphite assets into a newly incorporated Norway company branded as Ascent Graphite.

On April 26, Mineral Commodities Ltd. announced: “Priority targets identified at Bukken, Hesten and Vardfjellet graphite prospects near Skaland.”

On April 29, Mineral Commodities Ltd. announced: “Quarterly activities report–March 2022.” Highlights include:

After quarter end:

- “….Successful grant application of US$3.94M to advance commercialisation of a new graphite ore-to-battery anode business.

- Resolution of Section 102 mining right appeals.

- Priority targets identified at Bukken, Hesten and Vardfjellet graphite prospects near Skaland.

- Electromagnetic survey results indicate excellent new targets at the Munglinup Graphite Project.”

On April 29, Mineral Commodities Ltd. announced: “MRC unveils five year strategic plan 2022-2026.”

On May 18, Mineral Commodities Ltd. announced: “Strategic collaboration agreement with Mitsubishi Chemical Corporation.” Highlights include:

- “MOU with leading anode materials manufacturer Mitsubishi Chemical Corporation.

- Early entry into European anode materials supply chain via Phase 1 Toll Manufacturing Agreement.

- Broader business collaboration in Phase 2 for manufacturing and sale of high-quality active anode materials in Europe, leveraging…..

- Phase 2 will position MRC as Europe’s first vertically integrated graphite ore-to-active anode materials supplier…..”

On May 20, Mineral Commodities Ltd. announced:

MRC signs graphitic anode sales and marketing MOU with Traxys. Exclusive Graphite Anode Agency Sales and Marketing Memorandum of Understanding (MOU) signed with Traxys for MRC’s downstream graphite anode products including coated, spherical and/or purified graphite produced from Skaland and Munglinup concentrate.

Tirupati Graphite [LSE:TGR]

On April 28, Tirupati Graphite announced:

Transaction Update – Variation of long stop date. Tirupati Graphite plc (TGR.L, TGRHF.OTCQX), the specialist graphite and graphene company developing sustainable new age materials, announces the following update to its agreement to acquire the entire issued share capital of Suni Resources SA from Battery Minerals Limited as announced on 17 August 2021. The acquisition of Suni Resources will mean that Tirupati will hold the advanced Montepuez and Balama Central graphite projects in Mozambique, alongside associated technical intellectual property related to the assets….

Graphite developers

Northern Graphite [TSXV:NGC][GR:ONG] (OTCQX:NGPHF) (potential to be a North American graphite producer very soon)

Northern Graphite has agreed to purchase from Imerys the Lac des Iles producing graphite mine in Quebec and the Okanjande graphite deposit/Okorusu processing plant in Namibia. They also own the Bissett Creek graphite project located 100km east of North Bay, Ontario, Canada and close to major roads and infrastructure. The Company has completed an NI 43-101 Bankable final Feasibility Study and received its major environmental permit.

On May 2, Market Screener reported: “Northern Graphite: Closes acquisition of two graphite mines.” Highlights include:

- “The Company is now the only significant North American natural graphite producer and has acquired an established customer base and market share.

- Northern has acquired 40-50,000 tonnes per year (“tpy”) of graphite production capacity in Quebec and Namibia, which will make it the third largest non Chinese natural graphite producing company.

- The Company also has two large scale development projects, Bissett Creek in Ontario and an expansion of Okanjande in Namibia, which it intends to build to meet growing EV demand.

- Bissett Creek has bee

n independently rated as the highest margin graphite project in the world. - The Okanjande deposit has large measured and indicated resources and the Company intends to assess building a new processing plant with 100-150,000 tpy of production capacity.

- The LDI, Bissett Creek and Okanjande deposits are all located close to infrastructure in politically stable countries with high ESG standards.

- All deposits have high quality flake graphite that is suitable for all battery and industrial applications.

- The Acquisition has been completed in a very capital efficient manner that minimizes shareholder dilution. Common shares outstanding have increased from approximately 80 million to slightly less than 120 million.”

You can view the latest investor presentation here and the latest Trend Investing article on Northern Graphite here or the very recent and excellent Trend Investing CEO interview here.

Westwater Resources (NYSE:WWR)

Westwater Resources Inc. is developing an advanced battery graphite business in Alabama. The Coosa Graphite Plant (2023 production start) plans to source natural graphite initially from non-China suppliers and then from the USA from 2028.

On May 11, Westwater Resources Inc. announced: “Westwater Resources, Inc. announces results for first quarter ended March 31, 2022 & business update.” Highlights include:

- “Net cash used in operations was $2.1 million lower for the three months ended March 31, 2022, compared to the same period in 2021. The decrease in cash used in operations was a result of reduced product development expenses and arbitration costs.

- Consolidated net loss for the three months ended March 31, 2022, was $2.8 million, or $0.08 per share, compared to a net loss of $5.4 million, or $0.19 per share, for the same period in 2021. The $2.6 million reduction in net loss was due primarily to decreased product development expenses and arbitration costs.

- Cash and working capital as of March 31, 2022, was $116.0 million consistent with our cash balance at December 31, 2021…..The decrease in working capital was primarily the result of costs incurred during the quarter of $14.5 million related to the Kellyton graphite processing plant, and operating cash expenditures of $2.7 million…..”

You can view the latest investor presentation here.

Gratomic Inc. [TSXV:GRAT] [GR:CB82 ] (OTCQX:CBULF)

Gratomic’s Aukam Graphite Project is located in Namibia, Africa. The Project is undergoing ‘operational readiness‘. Gratomic also 100% own the Capim Grosso Graphite Project in Brazil. Gratomic is also collaborating with Forge Nano to develop a second facility for graphite micronization and spheronization.

On May 2, Gratomic Inc. announced:

Gratomic provides drilling update on Capim Grosso Graphite Project. Gratomic Inc. announces that 1,734.30 m of the 5,000-meter drilling campaign on its Capim Grosso graphite project has been completed. 15 diamond drillholes were completed to date, with two additional holes in progress. The project is located in the Bahia State of Brazil, with the Company holding a 100% controlling interest in the property……

On May 4, Gratomic Inc. announced:

Gratomic provides trenching update on Jacobina Graphite Project….This initial trench proved that the property is highly prospective for graphite mineralization.

On May 9, Gratomic Inc. announced:

Gratomic provides further drilling update on Capim Grosso Graphite Project. Gratomic Inc. announces that 2,047.5 m of the 5,000-meter drilling campaign on its Capim Grosso graphite project has been completed.

On May 24, Gratomic Inc. announced:

Gratomic discovers possible largest graphite vein ever recorded at its Aukam Project in Namibia. Gratomic Inc.is pleased to announce an update on the planned 1,250 m Diamond Drill [DD] campaign currently underway at Aukam. The drillholes are planned to intersect mineralization below the current mine adits. The first hole of 2022 (AKD001) is a twin hole of AKR026, which was drilled towards the end of 2021…..

Walkabout Resources Ltd [ASX:WKT]

On April 29, Walkabout Resources announced: “March 2022 quarterly activities report.” Highlights include:

Lindi Jumbo Graphite Mine – Tanzania

- “Multiple consignments from China have reached Tanzania and been transported to site.

- Jinpeng mechanical construction team now on site.

- Final Condition Precedent submitted to CRDB to enable commencement of debt drawdown.

- Demand continues to outstrip supply for flake graphite with prices rising between 10% and 37% in just six months…..”

UK Projects

- “Maiden diamond drilling program completed in Scotland, assay results pending.”

Corporate

- “Australian Shareholder Roadshows conducted in Perth, Melbourne and Sydney during March.”

Black Rock Mining [ASX:BKT] (OTCPK:BKTRF)

On May 6, Black Rock Mining announced: “Black Rock raises $25m in placement to institutional and sophisticated investors.” Highlights include:

- “Black Rock raises A$25m at A$0.24 per share in a strongly supported Placement to new and existing institutional and sophisticated investors.

- Funds will be used to strengthen Black Rock’s balance sheet ahead of project financing, advance the development of the Company’s Mahenge Graphite Mine, and for general and corporate purposes.

- Commencement of construction of the Mahenge Graphite Mine remains on track for Q3 CY2022.”

NextSource Materials Inc. [TSX:NEXT] [GR:1JW] (OTCQB:NSRCF)

NextSource Materials Inc. is a mine development company based in Toronto, Canada, that’s developing its 100%-owned, Feasibility-Stage Molo Graphite Project in Madagascar. The Company also has the Green Giant Vanadium Project on the same property. The Molo mine is fully-funded and scheduled to commission in March, 2022.

On April 28, NextSource Materials Inc. announced:

NextSource Materials announces initiation of civil works and shipment of buildings to the Molo Graphite mine site in Madagascar and filing of updated PEA. President and CEO, Craig Scherba commented, “With the mobilization of construction crews to the mine site and initiation of civils and earthworks, we have reached yet another key milestone towards commissioning of the Molo Graphite mine later this year.”

On May 24, NextSource Materials Inc. announced:

NextSource Materials announces solar and battery hybrid power plant construction and site works update…..

Investors can view the latest company presentation here or the latest Trend Investing article here.

Nouveau Monde Graphite [TSXV:NOU] (OTCQX:NMGRF) (NYSE:NMG) and Mason Graphite [TSXV:LLG] [GR:M01] (OTCQX:MGPHF)

Nouveau Monde Graphite (“NMG”) own the Matawinie graphite project, located in the municipality of Saint-Michel-des-Saints, approximately 150 km north of Montreal, Canada. NMG (51%) and Mason Graphite (49%) have agreed to JV (subject to approvals) on the Lac Guéret Project.

On May 13, Nouveau Monde Graphite announced: “NMG provides a quarterly update amid favorable shift in battery material market conditions.” Highlights include:

- “Enhanced engagement towards offtake agreement with potential tier-1 customers in the EV and battery sector with the production of A and B samples, site visits, quality checks and commercial discussions.

- OEMs, feeling the supply chain pressure, are turning their attention upstream to secure supplies and reduce their risks as projections indicate a flake graphite deficit of nearly 2 million tonnes per annum by the end of the decade.

- Timely progress on construction of the Company’s Phase-1 coating unit, commissioning still targeted to start before the end of H1-2022 to complete NMG’s vertically integrated 2,000-tpa nameplate ore-to-battery-material value chain.

- Significant advancement (75%) of engineering, project management, the mining plan update and economic structure for NMG’s integrated 43-101-compliant feasibility study for the Phase-2 Bécancour Battery Material Plant and Matawinie Mine; conclusions planned to be announced before the end of Q2-2022.

- Continuous progress of detailed engineering for Phase-2 Matawinie Mine.

- Progress in structuring and securing project financing for the construction and development of the Phase-2 Bécancour Battery Material Plant and Matawinie Mine; NMG has received non-binding letters of interest from two Export Credit Agencies…..”

On May 16, Nouveau Monde Graphite announced: “Nouveau Monde and Mason Graphite announce strategic investment and conditional option and joint venture agreement on Lac Guéret Project.” Highlights include:

- “On closing, NMG and Mason Graphite to enter into an option and joint venture agreement (the “Option and JV Agreement”) pursuant to which the parties will collaborate to advance the Property, based in Québec, Canada, with a view to form a joint venture…..

- Assuming the exercise of the option and formation of the Joint Venture, NMG’s and Mason Graphite’s interest in the Joint Venture to be 51% and 49%, respectively, and NMG to be appointed as operator of the Joint Venture.

- Joint Venture to be funded by NMG and Mason Graphite on a pro rata basis; failure to fund work program commitments in the Joint Venture to result in a 1% dilution for each unfunded tranche of C$5.0 million.

- The Joint Venture will have full access to NMG’s Phase-1 natural graphite flake concentrator plant currently in operation in Saint-Michel-des-Saints, Québec (the “Demonstration Plant”) in order to accelerate the qualification and commercialization of its graphite, which has been proven instrumental as per NMG’s recent successful experience. To date, NMG has invested approximately C$30.0 million in the Demonstration Plant…….

- The Property is notably sizable, with a total Measured and Indicated Resource of 65.5 million tonnes grading 17.2% Cg, and carries one of the highest grades of graphite ore globally with a Proven and Probable Reserve totalling 4.7 Mt grading 27.8% Cg (See Mason Graphite’s press release dated September 25, 2015). Mason Graphite received the governmental authorization for the Property, via the issuance of the Decree 608-2018 by the Québec Government.

- NMG and Black Swan Graphene Inc. (“Black Swan”), a subsidiary of Mason Graphite, intend to enter into a non-binding letter of intent for the implementation of Black Swan’s graphene processing technology in NMG’s Demonstration Plant……

- The entering into of the Option and JV Agreement is subject to the approval of the TSX Venture Exchange (the “TSX-V”) and the shareholders of Mason Graphite at a special meeting of shareholders of Mason Graphite to be called and expected to be held on or about the first week of July 2022.”

On May 19, Nouveau Monde Graphite announced: “NMG releases 2021 ESG report and provides notice of its annual general and special meeting of shareholders.”

You can view the latest investor presentation here.

Greenwing Resources

Limited [ASX:GW1] (OTCPK:BSSMF) (formerly Bass Metals [ASX:BSM])

On April 29, Greenwing Resources Limited announced: “Quarterly activities report – March 2022 quarter 29 April 2022.” Highlights include:

- “Planning underway for a maiden drilling program at the San Jorge Lithium Project……

- Drilling program completed at Graphmada Graphite Mining Complex with the aim to significantly expanding the mineralisation footprint: 69 diamond holes for a total of 3,268 metres. Recording of significant intercepts of graphite mineralisation up to 60.3m @ 6.1% Fixed Carbon (FC) including 14.6m @ 8.9% FC. Planned Mineral Resource upgrade from existing resource of 22.0 Mt @ 4.0% Total Graphite Carbon (TGC) expected to be completed next quarter.“

You can view the latest company presentation here.

Triton Minerals [ASX:TON][GR:1TG]

Triton Minerals Ltd. engages in the acquisition, exploration and development of areas that are highly prospective for gold, graphite and other minerals. The company was founded on March 28, 2006 and is headquartered in West Perth, Australia. Triton has two large graphite projects in Mozambique, not far from Syrah Resources Balama project.

On April 27, Triton Minerals announced: “Placement to raise up to approximately $4.1 million…..”

You can view the latest investor presentation here and the latest article on Trend Investing here.

Magnis Energy Technologies Ltd [ASX:MNS] (OTCPK:MNSEF)

Magnis is an Australian based company that has rapidly moved into battery technology and is planning to become one of the world’s largest manufacturers of lithium-ion battery cells. Magnis has a world class graphite deposit in Tanzania known as the Nachu Graphite Project.

On April 29, Magnis Energy Technologies Ltd. announced: “Quarterly report 29th April 2022.” Highlights include:

- “At the end of March 2022, Imperium3 New York LLC (“iM3NY”), continued to make progress towards fully automated production at its Lithium-ion battery manufacturing facility located in New York State……

- Post the quarter end, iM3NY closed an Intellectual Property-based Financing for US$100 million which will be used to lower the cost of capital and fast-track expansion.…..

- Global engineering consulting firm Ausenco has been hired to begin updating the previous 2016 Bankable Feasibility Study for the Nachu Graphite Project.

- Construction begins on Eco-village resettlement housing village.

- Corporate Social Responsibility programs continue as the Chunyu Mtumbuni Primary School project nears completion……

- Magnis Energy Technologies Ltd joins the S&P Dow Jones ASX All-Ordinaries Index.“

On May 5, Magnis Energy Technologies Ltd. announced: “Exceptional anode results continue using mechanical processes only.” Highlights include:

- “Significant results continue for a high performance CSPG (Coated Spherical Graphite) anode product qualified using commercial grade Lithium-ion battery cells.

- Downstream anode pilot plant has been operating at Binghamton University, USA for over 6 years.

- Greener, energy-saving proprietary anode processing technology producing a high yield (70%) CSPG product with low carbon footprint.

- +99.95% CSPG produced without any chemical, acid and thermal purification,

- Intrinsic high-purity, high-quality graphite feedstock from Magnis’ Nachu project in Tanzania.”

Eagle Graphite [TSXV:EGA] (OTCPK:APMFF)

The Black Crystal Project is located in the Slocan Valley area of British Columbia, Canada, 35km West of the city of Nelson, and 70km North of the border to the USA. The quarry and plant areas are the project’s two main centers of activity.

No news for the month.

Talga Group [ASX:TLG] [GR:TGX] (OTCPK:TLGRF)

Talga Group is a technology minerals company enabling stronger, lighter and more functional materials for the multi-billion dollar global coatings, battery, construction and carbon composites markets using graphene and graphite. Talga 100% owned graphite deposits are in Sweden, proprietary process test facility is in Germany.

On April 29, Talga Group announced: “Quarterly activities review for period ending31 March 2022.” Highlights include:

Commercial and project development

- “Successfully commissioned and operating the Electric Vehicle Anode (EVA) plant in northern Sweden….

- 23 customers including Tier 1 battery and automotive manufacturers progressed to advanced qualification trials and engaged to receive Talnode®–C samples from the EVA.

- Major permitting milestone achieved for Talga’s Vittangi Graphite Project subsequent to period.”

Corporate and finance

- “Change of Registered Office and Principal Place of Business.

- Launch of new Talga Group global website.….

- Cash balance of A$22million as at31 March 2022.”

You can view the latest investor presentation here.

SRG Mining Inc. [TSXV:SRG] [GR:18Y] (OTC:SRGMF) [Formerly SRG Graphite Inc.]

SRG is focused on developing the Lola graphite deposit, which is located in the Republic of Guinea, West Africa. The Lola Graphite occurrence has a prospective surface outline of 3.22 km2 of continuous graphitic gneiss, one of the la

rgest graphitic surface areas in the world. SRG owns 100% of the Lola Graphite Project.

On May 18, SRG Mining Inc. announced:

SRG Mining announces strategic corporate update. Updated feasibility study underway to double mine production. Second transformation CSPG Preliminary Economic Assessment also Awarded. The Company announced today the start of an independent, updated feasibility study (the “Updated Feasibility Study” or “UFS”), which will include basic engineering, to confirm technical opportunities and capital and operating costs for target initial production of 100,000 tonnes per annum (“tpa”) of graphite as concentrate from the Lola Project. The UFS follows the 2019 Feasibility Study which was prepared by DRA Global Limited (“DRA”)….. The Company is advancing discussions with multiple parties who have expressed interest in providing debt financing to advance SRG towards first production. Binding offtake offers have been received for more than 50% of the initial 100,000 tpa graphite concentrate production……

You can view the latest investor presentation here.

Leading Edge Materials [TSXV:LEM] (OTCQB:LEMIF)

Leading Edge Materials Corp. is a Canadian company focused on becoming a sustainable supplier of a range of critical materials. Leading Edge Materials’ flagship asset is the Woxna Graphite Project and processing plant in central Sweden. The company also owns the Norra Karr REE project, and the 51% of the Bihor Sud Nickel-Cobalt exploration stage project in Romania.

On May 17, Leading Edge Materials Corp. announced: “Leading Edge Materials signs exploration license for Romanian Nickel and Cobalt Project.”

Investors can view the latest company presentation here.

Renascor Resources [ASX:RNU](OTC:RSNUF)

Renascor Resources Ltd. is an Australian exploration company, which focuses on the discovery and development of economically viable deposits containing uranium, gold, copper, and associated minerals. Its projects include graphite, copper, precious metals, and uranium.

On April 29, Renascor Resources announced: “Quarterly activities report for the period ended 31March 2022.” Highlights include:

- “The Australian Government, through Export Finance Australia, conditionally approved an A$185 million loan facility to support the development of the Renascor’s planned vertically integrated graphite mine and battery anode material manufacturing operation in South Australia (the Siviour Project).

- Commercial–scale downstream milling trials achieved spherical graphite yields from Renascor’s Siviour Graphite Deposit in South Australia in excess of 65%, an improvement versus the 50% yield adopted in Renascor’s Battery Anode Material Study (BAM Study).

- Renascor completed a bulk production campaign to produce large–scale samples of Siviour Purified Spherical Graphite [PSG] for customer qualification purposes for existing and potential offtake partners for the Siviour Project.

- Renascor is progressing work on an updated, optimised BAM Study that is assessing an increase in Stage 1 PSG production capacity, as well as additional staged expansions of PSG operations in order to meet projected demand. Studies to date have considered an initial Stage 1 production capacity of 28,000tpa PSG.

- PSG, which is used in the production of anodes for lithium–ion batteries, is experiencing further substantial upward price improvement, with Fastmarkets reporting PSG prices of US$3,500 to US$3,800 per tonne, a 40% increase over the last six months, and–194 mesh (a common feedstock for PSG) increasing by 48% to US$830 per tonne…..

You can view the latest investor presentation here.

EcoGraf Limited [ASX:EGR] [FSE:FMK] (ECGFF)

On April 29, EcoGraf Limited announced: “Quarterly activities report. Australian government conditionally approves US$40m expansion loan for HFfree battery anode material facility.” Highlights include:

EcoGraf™ Battery Anode Material

- “Australian Government announces conditional approval for EcoGraf US$40m expansion loan to support the Company’s HFfree Battery Anode Material Facility.

- Construction program advancing with submission of regulatory approval proposals and preparation for commencement of initial site works and installation of underground site services.

- WA site lease agreement with State Government land agency Development WA in place for execution once approvals secured.

- Finalising contractual arrangements for award of construction engineering and key process equipment procurement programs.

- Additional process refinements identified from the commercial scale mechanical shaping program expected to deliver increased product yields of over 60%.

- EcoGraf™ HFfree process optimisation results indicate reduced consumption of reagents and improved operating efficiencies.

- Discussions with prospective customers in Asia, Europe and North America in relation to offtake, investment and product development opportunities.

- New Australian facility flowsheet configured to maximise product yields and allow value-adding of by-products to capitalise on new product market opportunities.”

EcoGraf™ Ba

ttery Recycling

- “Increased industry focus on closed loop battery supply chains and anode recycling.

- EcoGraf™ HFfree recovered anode material undergoing electrochemical testing with SungEel Hitech in Korea.

- Engagement of European anode recycling specialist as discussions progress with potential partners.”

EcoGraf™ Natural Flake Graphite.

- “Government recognition for Epanko at annual Tanzanian mining and investment conference.

- Funding program advancing with multiple financial institutions undertaking due diligence…..

Corporate

- “Cash at end of quarter of $48.1 million.

- EcoGraf included in All Ordinaries Index from 21 March 2022.

- DTC eligibility granted for trading of EcoGraf shares on the OTCQX market in the US.”

On May 12, EcoGraf Limited announced: “Approval update for construction of EcoGraf HFfree™ BAM Facility…..”

On May 20, EcoGraf Limited announced: “EcoGraf TanzGraphite expansion options to support market growth. Epanko and Merelani-Arusha to provide a scalable, long-term TanzGraphite production hub for key export regions.” Highlights include:

- “Commenced evaluation of options for significant expansion of the Epanko Graphite Project beyond its initial 60,000tpa capacity……”

You can view the latest investor presentation here.

Lomiko Metals Inc. [TSXV:LMR] (OTCQB:LMRMF)

Lomiko has two projects in Canada – La Loutre graphite Project (flagship) (100% interest) and the Bourier lithium Project (70% earn in interest).

On April 28, Lomiko Metals Inc. announced:

Lomiko announces positive results on its initial metallurgical test programs at its La Loutre Graphite Project with results indicating purity of >99.9% C[T] of its concentrate and positive response of samples to expanded graphite for all Flake sizes tested…..

On May 16, Lomiko Metals Inc. announced:

Lomiko provides update on Strategy and Regional Flake Graphite Exploration Program. Belinda Labatte, CEO and director of Lomiko stated: “Our team is keen to take on new opportunities in the region, around our La Loutre property, as we develop the potential for natural flake graphite via organic growth and acquisition…….The Company has staked approximately 14,255 hectares of mineral claims, 236 claims in total, on six projects in the Laurentian region of Quebec and within First Nations territory. These new claims lie within a 100 km radius of the Company’s flagship La Loutre graphite project and 28 claims are directly contiguous to La Loutre, with the Company claim package now covering 4,528 hectares……

On May 19, Lomiko Metals Inc. announced:

Lomiko announces commencement of exploration drilling for its La Loutre Graphite Project……The program anticipates approximately 18,000 meters in 120 holes to be drilled at the “Electric Vehicle” or “EV” and the Battery zones.

Zentek Ltd. [TSXV:ZEN] (ZTEK)(formerly ZEN Graphene Solutions Ltd.)

On May 13, Zentek Ltd. announced: “Zentek announces sales and distribution of ZenGUARD™ masks through Mark’s in Canada.”

On May 19, Zentek Ltd. announced: “Zentek’s Rapid Diagnostic Platform receives two NSERC grants towards commercialization.”

South Star Battery Metals [TSXV:STS] (OTCQB:STSBF)

South Star Battery Metals owns the Santa Cruz Graphite Project in Brazil with a Phase 1 commercial production target for Q4 2022. Plus the right to earn-in to up to 75% for the Graphite Project in Coosa County, Alabama.

On May 3, South Star Battery Metals announced:

South Star Battery Metals announces small-scale pilot metallurgical testing program for Alabama Graphite Project…..The small-scale pilot test will also generate approximately 15kg of concentrates (> 94% Cg) as well as intermediate products and tailings samples for future geotechnical, chemical, and physical testing programs to better characterize the ore, the tailings as well as final concentrates…..

Sovereign Metals [ASX:SVM] [GR:SVM][LSE:SVML] (OTCPK:SVMLF)

Sovereign Metals Ltd. is an exploration company, which engages in the explorations of graphite, copper and gold resources. It operates through the Queensland, Australia and Malawi geographical segments. Sovereign Metals has world’s biggest graphite saprolith resource of 65m tonnes at 7.1% TGC at their Maligunde project in Malawi.

On April 29, Sovereign Metals announced: “March 2022 quarterly report.” Highlights include:

MRE upgrade confirmed Kasiya as the largest rutile deposit ever discovered

- “1.8 Billion tonnes @ 1.01% rutile and 1.32% graphite (Indicated + Inferred)equating to18 million tonnes contained rutile and 23 million tonnes contained graphite.

- The updated Mineral Resource Estimate (MRE) confirmed Kasiya as the world’s largest rutile deposit and one

of the largest flake graphite deposits globally. - High global resource grade @ 1.64% RutEq.* (recovered rutile + recovered graphite).

- 662 Mt (37%) of the total MRE reports to the Indicated category with remainder in Inferred category.”

Updated Scoping Study underway

- “Updated Scoping Study to build on initial study reflecting the substantial MRE scale increase and to examine the impact of higher grades, increased production volumes and increased mine-life.”

On May 3, Sovereign Metals announced: “Institutional placement to raise $15m.”

You can view the latest investor presentation here.

Other graphite juniors

Armadale Capital [AIM:ACP], BlackEarth Minerals [ASX:BEM], DNI Metals [CSE:DNI] (OTCPK:DMNKF), Eagle Graphite [TSXV:EGA] [GR:NJGP] (OTC:APMFF), Electric Royalties [TSXV:ELEC], Focus Graphite [TSXV:FMS][GR:FKC] (OTCQB:FCSMF), Graphite One Resources Inc. [TSXV:GPH] [GR:2JC] (OTCQX:GPHOF), Green Battery Minerals Inc. [TSXV:GEM] (OTCQB:GBMIF), International Graphite [ASX:IG6], Metals Australia [ASX:MLS], New Energy Metals Corp. [ASX:NXE], Volt Resources [ASX:VRC] [GR:R8L].

Synthetic Graphite companies

- SGL Carbon (ETR:SGL)

- Novonix Ltd [ASX:NVX](OTCQX:NVNXF)

Graphene companies

- Archer Materials [ASX:AXE] (OTCPK:ARRXF)

- Elcora Advanced Materials Corp. [TSXV:ERA](OTCPK:ECORF)

- First Graphene [ASX:FGR] (OTCQB:FGPHF)

- Graphene Manufacturing Group Ltd [TSXV:GMG] (OTCPK:GMGMF)

- NanoXplore Inc. [TSXV:GRA] (OTCQX:NNXPF)

- Strategic Elements Ltd [ASX:SOR] (OTCPK:SORHF)

- Zentek Ltd. [TSXV:ZEN] (ZTEK)

Conclusion

May saw flat flake graphite prices.

Highlights for the month were:

- BMI: There could be a deficit of around 40,000 tonnes of graphite this year.

- Pentagon asks Congress to fund mining projects in Australia, U.K. The U.S. Defense Production Act already covers USA and Canada.

- Severe global battery shortage likely post 2025, GlobalData forecasts.

- Syrah Resources reports strong flake graphite demand, sales up 80% in Q1 2022. AAM Vidalia facility (11.25ktpa) targeted to start production in the September 2023 quarter.

- Mineral Commodities Ltd signs strategic collaboration MOU with leading anode materials manufacturer Mitsubishi Chemical Corporation. Signs graphitic anode sales and marketing MOU with Traxys.

- Northern Graphite closes acquisition of two graphite mines from Imerys SA.

- Black Rock Mining raises A$25m in placement to institutional and sophisticated investors.

- NextSource Materials announces initiation of civil works and shipment of buildings to the Molo Graphite mine site in Madagascar.

- Nouveau Monde Graphite reports: “projections indicate a flake graphite deficit of nearly 2 million tonnes per annum by the end of the decade.” Nouveau Monde and Mason Graphite announce strategic investment and conditional option and JV agreement on Lac Guéret Project.

- Magnis Energy Technologies reports exceptional anode results continue using mechanical processes only.

- Talga Group now has 23 customers including Tier 1 battery and OEMs progressed to advanced qualification trials and engaged to receive Talnode®–C samples.

- SRG Mining updated FS underway to double mine production.

- Renascor Resources progressing work on an updated, optimised BAM Study.

- EcoGraf has conditional approval for US$40m expansion loan to support the Company’s HFfree Battery Anode Material Facility.

- Lomiko Metals announces positive results on its initial metallurgical test programs at its La Loutre Graphite Project, results indicating purity of >99.9% C.

- Zentek announces sales and distribution of ZenGUARD™ masks through Mark’s in Canada.

- Sovereign Metals confirms Kasiya as the world’s largest rutile deposit and one of the largest flake graphite deposits globally.

As usual, all comments are welcome.