Olemedia/E+ via Getty Images

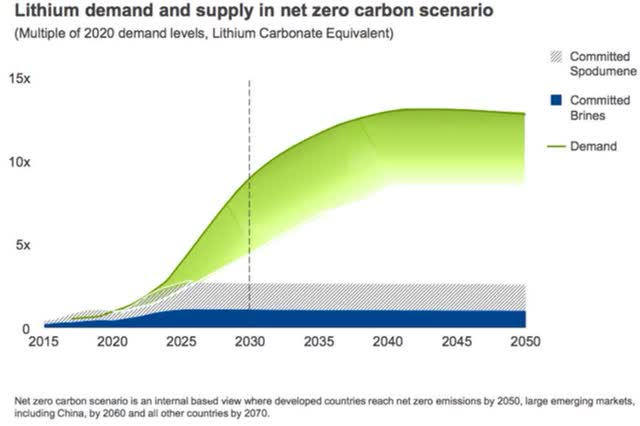

Welcome to the May 2022 edition of the “junior” lithium miner news. We have categorized those lithium miners that won’t likely be in production before 2023 as the juniors. Investors are reminded that many of the lithium juniors will most likely be needed in the mid and late 2020’s to supply the booming electric vehicle [EV] and energy storage markets. This means investing in these companies requires a higher risk tolerance and a longer time frame.

May saw very good progress for many of the lithium juniors as well as two major lithium players (MIN and LAC) buying into lithium juniors.

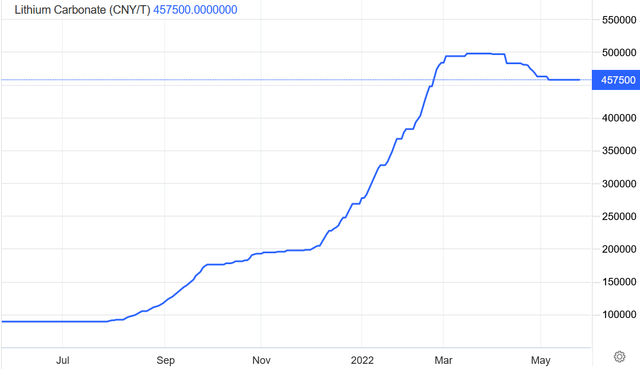

Lithium spot and contract price news

Asian Metal reported during the past 30 days, 99.5% China lithium carbonate spot prices were down 0.93% and lithium hydroxide prices were down 0.94%. Lithium Iron Phosphate (Li 3.9% min) prices were down 2.24%. Spodumene (6% min) prices were up 13.78% over the past 30 days.

Benchmark Mineral Intelligence (“BMI”) as of mid-May reported China lithium carbonate prices of RMB 462,500/tonne (US$68,450) (battery grade), and for lithium hydroxide RMB 473,000/tonne ($70,000), and stated (no link available): “Despite the temporary softening in prices, expectations are that prices will see further upside overall in H2 2022, once COVID restrictions are lifted, given that market supply remains exceptionally tight and any hindered demand from Q2 will likely be pushed into the latter half of the year.”

Metal.com reported lithium spodumene concentrate (6%, CIF China) price of CNY 31,652 (~USD 4,757/mt), as of May 24, 2022. See also Pilbara Minerals news where their BMX auctions are achieving much higher prices. The May 24 auction achieved US$5,650/dmt (SC 5.5%) or ~US$6,586 /dmt (SC6.0%, CIF China basis).

China Lithium carbonate spot price – CNY 457,500 (~USD 68,758)

Trading Economics

Rio Tinto’s lithium emerging supply gap chart (chart from 2021)

Rio Tinto

Lithium market news

For a summary of the latest lithium market news and the “major” lithium company’s news, investors can read: “Lithium Miners News For The Month Of May 2021” article. Highlights include:

- CATL’s expects their battery production capacity to go from 170GWh in 2021 to 670GWh by 2025, a 3.9x increase in just 3 years.

- Canada in ‘active discussions’ with EV supply chain companies – minister.

- Li-Cycle and Glencore announce Global Strategic Partnership; Glencore to make a $200 million investment in Li-Cycle.

- Gotion High-Tech signs MOU for lithium mining in Argentina.

- Green Lithium inks deal to develop European (UK-based) lithium refinery using Trafigura feedstock.

- Update to Defense Production Act: US now expands definition of “domestic source” of battery raw materials to include UK, Australia and Canada.

- POSCO to invest $20 billion in battery materials to rival Chinese firms.

- Chile’s constitutional assembly rejects plans to nationalise parts of mining sector.

-

BMI: Lithium industry needs to invest $42 billion by end of the decade to meet demand.

-

CNBC: EV battery costs could spike 22% by 2026 as raw material shortages drag on.

- BMI global gigafactory pipeline at 304. There is now a 6,387.6 GWh pipeline of battery capacity.

- Stellantis CEO warns of EV battery shortage, followed by lack of raw materials.

- Analysts turn more bullish on lithium after Pilbara’s record deal.

- Pilbara Minerals achieves record spodumene auction price in May of US$5,650/dmt (SC 5.5%) or ~US$6,586 /dmt (SC6.0, CIF China basis).

Junior lithium miners company news

Sayona Mining [ASX:SYA] (OTCQB:SYAXF)

On April 29, Sayona Mining announced: “March 2022 quarterly activities report.” Highlights include:

Québec, Canada

- “Northern Québec lithium Hub expanded, with 121 new claims acquired at Lac Albert Project, 3.5km west of Moblan Lithium Project.

- JORC resource base doubles for Sayona’s North American Lithium (NAL) and Authier Projects, with combined Measured, Indicated and Inferred Mineral Resource of 119.1 Mt @ 1.05% Li 2O.

- Sayona enters S&P/ASX 300 Index after substantial increase in mark

et value to approx. A$2.5 billion.”

Western Australia

- “Preparations for 60‐hole air‐core drilling at Deep Well Project completed; 100% owned lithium tenure plans advance.”

Post‐Quarter.

- “Positive battery test results from NOVONIX reaffirm Authier spodumene’s high quality.

- Earn‐in partner Morella Corporation (ASX:1MC) commences drilling at Mallina Lithium Project.

- New lithium pegmatite discovery at Moblan, demonstrating potential for expanded resource.”

On May 23, Sayona Mining announced: “Positive Pre‐feasibility Study enhances NAL value.” Highlights include:

- “Positive Pre‐feasibility Study (PFS) shows value of North American Lithium [NAL] operation in Québec, Canada confirming technical and financial viability over 27‐year life of mine.

- Pre‐tax net present value (NPV) (8% discount) estimated at approx. A$1 billion, with pre‐tax internal rate of return (IRR) of 140% and capital payback within two years.

- Modest capex for NAL restart of approx. A$100M, with upgrades to improve operational efficiency, grade, quality and recovery; long‐lead equipment already ordered to facilitate Q1 2023 restart.

- Results confirm potential for Abitibi lithium hub, adding to emerging northern hub and facilitating downstream processing as Company bolsters leading position in North American lithium industry.”

Investors can read the Company presentation here, and a Trend Investing CEO interview here.

Note: North American Lithium [NAL] is owned 75% Sayona Mining: 25% Piedmont Lithium.

Upcoming catalysts include:

- 2022 – Authier permitting. Possible project financing and off-take.

- Q1 2023 – Restart of NAL (SYA 75%: PLL 25%) operations.

Piedmont Lithium [ASX:PLL] (Nasdaq:PLL)

Piedmont Lithium 100% own the Carolina Lithium spodumene project in North Carolina, USA; as well as 25% of North American Lithium [NAL].

On April 28, Piedmont Lithium reported:

Piedmont Lithium partner Sayona announces a new lithium pegmatite discovery at Moblan in Quebec… Assay results from two holes at the newly defined Moblan South Discovery have identified lithium mineralization at shallow depth, approximately 200m south of the main Moblan deposit. Results include 5m @ 1.85% Li2O from 3.5m and 35m @ 1.62% Li2O from 27.6m in hole DDH135 as well as 6.6m @ 1.69% Li2O from 2.1m and 27.2m @ 1.53% Li2O from 22.0m in hole DDH136. Additional drill hole results are pending. Piedmont holds an equity interest of approximately 16.5% in Sayona Mining.

Upcoming catalysts include:

- 2022 – Carolina Lithium – Possible further off-take, permitting or project funding announcements.

- Early 2023 – NAL (25% Piedmont Lithium) production set to begin.

You can view the company’s latest presentation here.

Vulcan Energy Resources [ASX: VUL] (OTCPK:VULNF)

Vulcan Energy Resources state that they have “the largest lithium resource in Europe” with a total of 15.85mt LCE, at an average lithium grade of 181 mg/L. The Company is in the development stage developing a geothermal lithium brine operation (geothermal energy plus lithium extraction plants) in the Upper Rhine Valley of Germany.

On April 28, Vulcan Energy Resources announced: “Quarterly activities report March 2022.” Highlights include:

- “Entered into an agreement with major chemicals company Nobian (previously part of AkzoNobel) to assess the feasibility of a joint project for the development, construction and operation of the Central Lithium Plant (CLP) after securing the site for the CLP in October 2021.

- Pre-fabrication of Vulcan’s Direct Lithium Extraction (DLE) – Demonstration Plant (Demo Plant) commenced offsite in Germany.

- Opened new laboratory in Karlsruhe-Durlach, Germany, extending the analytical capability and expertise of the Company’s lithium division.

- Awarded new exploration licenses for geothermal energy and lithium in the Upper Rhine Valley Geothermal Brine Field, increasing Vulcan’s granted license area by nearly 50% to over 1,000km2.

- Granted a new Research Permit in Italy, named “Cesano”, with high geothermal heat and high lithium grades recorded in historical drilling…

- Signed a binding lithium hydroxide offtake agreement with LG Energy Solution (LGES), following the binding term sheet signed on 18 July 2021.

- Strong financial position maintained, with the cash balance and liquid investments totalling €141 million at the end of March 2022. Capitalising on the Feed in Tariff for geothermal power, Vulcan’s operational geothermal renewable energy plant, Natürlich Insheim generated €1.7 million in revenue.

- Commenced trading on the Prime Standard regulated market of the Frankfurt Stock Exchange(FSE), following the submission of the application to dual list on 8 February 2022, the first ASX-listed company to do so.”

Subsequent events post-Quarter:

- “Vulcan and MVV Energie AG (MVV), the largest municipal energy supplier in Germany, executed a binding purchase agreement for 240 gigawatt hours per year of renewable heat for the next 20 years.”

Upcoming catalysts include:

- H2 2022 – DFS, potential permitting and project funding.

- 2024 – Target to commence production.

POSCO [KRX:005490] (PKX)

On May 18, POSCO announced: “POSCO Holdings to team up with Prologium to lead the all-solid-state battery market.” Highlights include:

- “Joint development of cathode materials, silicon anode materials, and solid electrolytes for all-solid-state battery and establishment of global supply system…”

Upcoming catalysts include:

- 2024 – Target to commence production at Hombre Muerto and ramp to 25ktpa LiOH.

Wesfarmers [ASX:WES] (OTCPK:WFAFY)(took over Kidman Resources)

The Mt Holland Lithium Project is a 50/50 JV between Wesfarmers [ASX:WES] (OTCPK:WFAFF) and SQM (SQM), located in Western Australia. There is also a proposal for a refinery located in WA. Wesfarmers acquired 100% of the shares in Kidman for A$1.90 per share, for US$545 million in total.

No lithium related news for the month.

You can view the latest company presentation here and news on the Mt Holland construction here.

Upcoming catalysts include:

- H2, 2024 – Mt Holland spodumene production and Kwinana LiOH refinery planned to begin and ramp to 45–50ktpa LiOH.

Liontown Resources [ASX:LTR] (OTC:LINRF)

Liontown Resources 100% own the Kathleen Valley Lithium spodumene project in Western Australia. DFS completed in November 2021.

On April 28, Liontown Resources announced: “March 2022 quarterly report.” Highlights include:

Kathleen Valley Lithium Project (LTR: 100%)

Project Development

- “Front-end Engineering and Design (FEED) activities continued with a focus on process flowsheet optimisation and the advancement of detailed design for the crushing and milling process areas.

- Procurement packages substantially advanced including the award of a key ~$10 million contract for the design, fabrication and delivery of a SAG Mill to Metso-Outotec, and multiple long lead items including vehicles and cranes.

- Tender submissions were received during the quarter for key works packages including onshore and offshore logistics and transport, the Kathleen Valley accommodation village and the hybrid solar-wind-gas power station. A review and evaluation of these submissions is progressing.

- Groundwater exploration activities progressed with three successful production bores completed…

- Advanced infill grade control drilling program scoped and commenced in April 2022 for both Mt Mann and Kathleen’s corner starter pits…

- Post DFS, FEED and procurement activities will enable the Company to finalise the project capital and operating costs. This will provide the board additional support to conclude the funding discussions with the banks and make its final investment decision currently planned for June 2022…”

Permitting and Heritage

- “Several key environmental and heritage approvals were submitted during the quarter, with additional approvals to be submitted in Q2, 2022.

- Positive ongoing engagement with the Tjiwarl Traditional Owners continued with all key heritage and environmental applications reviewed by the Tjiwarl prior to their submission to the various regulatory authorities and inclusion of the Tjiwarl in the procurement and tender process…”

Buldania Lithium Project (LTR: 100%)

- “Positive results were received from drilling at the Buldania Project, located 600km east of Perth. The results have confirmed the potential for incremental extensions at the main Anna lithium deposit and defining multiple new lithium mineralised pegmatites at the Northwest Prospect.

- The potential for incremental extension of the Anna Deposit, together with the lithium mineralisation identified at the Northwest Prospect, reinforces the Buldania Project as an emerging asset.”

Corporate

- “The Share Purchase Plan (SPP) announced on 1 December 2021 closed with subscriptions from eligible shareholders totalling A$12.9 million.

- Financing discussions continue to advance with domestic and international commercial banks, supported by strong Project economics, outstanding ESG credentials, offtake term sheets in place with tier-1 customers for >50% of production and completion of $450 million institutional placement.

- Cash balances and funds on deposit as at 31 March 2022 of A$466 million.”

On May 2, Liontown Resources announced: “Liontown and LG Energy Solution execute binding Offtake Agreement.” Highlights include:

- “…Initial 5-year term expected to commence in 2024, with the ability to extend for a further five years.

- LGES to purchase 100,000 dry metric tonnes (DMT) in the first year, increasing to 150,000 DMT per year in subsequent years.

- Pricing is determined using a formula-based mechanism referencing market prices for battery-grade Lithium Hydroxide Monohydrate.

- LGES is a global leader in delivering advanced lithium-ion batteries for electric vehicles (EVs), mobility and IT applications and energy storage systems.”

You can view the company’s latest presentation here.

AVZ Minerals [ASX:AVZ] (OTC:AZZVF)

AVZ Minerals owns 51% of its Manono Lithium & Tin Project in the DRC, after selling 24% of it to Suzhou CATH Energy Technologies for US240m. DRC-owned firm Cominiere has a 25% share.

On May 2, AVZ Minerals announced:

Extension of end date to the transaction implementation agreement… The Company confirms that the parties to the TIA have agreed to amend the end date to 31 May 2022 to provide for completion of closure formalities.

On May 4, AVZ Minerals announced: “Ministerial Decree to award the Mining Licence Manono Lithium and Tin Project.” Highlights include:

- “…The Ministerial Decree to award the Mining Licence covers the entirety of the Roche Dure JORC Mineral Resource and Reserve2&3 and the Carriere de l’Este exploration target.

- An area which was excluded under the Ministerial Decree to award the Mining Licence, will be renewed under a 5-year Exploration Licence to Dathcom, with discussions regarding the terms of the ongoing joint venture under discussion with the DRC Government.

- The transaction with CATH is progressing well with closure formalities expected to be finalised this month, providing CATH an indirect 24% interest in the Manono Project, whilst AVZ retains a majority stake of 51%.

- DRC Council of Ministers expected to meet to provide wide ranging support for all outstanding permitting and licencing requirements for the Manono Project.”

On May 11, AVZ Minerals announced:

AVZ Minerals Limited (ASX: AVZ) – Suspension from quotation description. The securities of AVZ Minerals Limited (‘AVZ’) will be suspended from quotation immediately under Listing Rule 17.2, at the request of AVZ, pending the release of an announcement regarding its mining and exploration rights for the Manono Lithium and Tin Project.

On May 23 Mining.com reported:

Chinese, Australian investors battle for largest lithium deposit… AVZ’s interest in the Manono lithium project in the Democratic Republic of Congo could fall to 36% from 75%, London-based short-seller Boatman said in a research report on Friday. That may follow its planned sale of a 24% stake this month and a flurry of lawsuits from companies, including Zijin Mining Group Co., claiming ownership, documents published by Boatman show.” At best, AVZ faces months or years of legal fights” to block a claim by a Zijin subsidiary, Boatman said in the report. “At worst, AVZ will lose control of Manono.”

Upcoming catalysts include:

- 2022 – Initial project work. FID on the Manono Project.

Standard Lithium [TSXV:SLI] (SLI)

On May 2, Standard Lithium announced:

Standard Lithium advances project pipeline as it commences Preliminary Feasibility Study at its South West Arkansas Lithium Project… Now we can manage and drive multiple projects in parallel. The commencement of this comprehensive PFS is a testament to the Company’s ambition to not only bring the first new commercial lithium project into production in the United States in six decades, but also to have a robust pipeline of subsequent projects that will serve the future demand for lithium chemicals in North America… We expect to complete the bulk of the work through the balance of 2022, with completion and reporting of the results of the PFS in Q1 2023.”

On May 3, Standard Lithium announced: “Standard Lithium sponsors the first electric vehicle charging stations in El Dorado, AR…”

On May 12, Standard Lithium announced: “Standard Lithium completes investment into Aqualung – An innovative carbon capture technology company.”

Global Lithium Resources [ASX:GL1]

On April 27, Global Lithium Resources announced: “Quarterly report for the period ending 31 March 2022.” Highlights include:

- “Maiden inferred JORC Mineral Resource estimate delivered for Manna Lithium Project of 9.9Mt @ 1.14% Li2O and 49 Ta2O5 ppm (100% basis).

- GL1 overall lithium attributable Mineral Resource base (Marble Bar 100%, Manna 80%) nearly doubles to 18.4Mt across its two projects in WA.

- Commencement of 380-hole, 60,000m Reverse Circulation (RC) drilling program at the Marble Bar Lithium Project (MBLP) targeting the southern extension of the Archer Resource area…

- Well supported A$29.9 million capital raising enables fast track of exploration activities, approvals and study work across Marble Bar and Manna Lithium Projects.

- Mineral

Resources Limited (ASX:MIN) becomes a strategic cornerstone investor with a 5% interest. - 10-year strategic spodumene concentrate offtake agreement with Suzhou TA&A Ultra Clean Technology Co, the controlling shareholder in lithium hydroxide producer Yibin Tianyi.

- Experienced lithium exploration manager Stuart Peterson appointed Head of Geology to lead development of Western Australian projects.”

On May 2, Global Lithium Resources announced: “Highest grade lithium assays delivered to date at Marble Bar Lithium Project. Positive drilling and assay results include 3m @ 2.5% Li2O.” Highlights include:

- “Significant high grade lithium assay results continue from recent drilling campaigns at the Marble Bar Lithium Project (MBLP)

- Results include: 3m @ 2.5% Li 2O and 32ppm Ta2O 5 from 67m in MBRC0244… 4m @ 2.18% Li 2O and 33ppm Ta2O 5 from 13m in MBRC0229. 3m @ 1.77% Li 2O and 29ppm Ta2O 5 from surface. 12m @ 0.53% Li 2O and 25ppm Ta2O 5 from 44m in MBRC0236. 6m @ 1.28% Li 2O and 63ppm Ta2O 5 from 58m in MBRC0242… 10m @ 0.64% and 49ppm Ta2O 5 from 11m in MBRC0253…

- Potential for lithium demonstrated in the east towards the Brockman Zone where a number of drillholes intercepted wide zones of lithium mineralisation – 12m @ 0.53% Li 2O and 20m @ 0.47 Li 2O in MBRC0236 in an area previously unexplored.

- Existing and newly identified lithium targets remain untested and will continue to be the focus for the CY2022 program which commenced in early February.”

On May 19, Global Lithium Resources announced: “Contractor mobilises to Manna Lithium Project for maiden drilling program. Initial 20,000m RC drilling campaign set to commence.”

Savannah Resources [LSE:SAV] [GR:SAV] (OTCPK:SAVNF)

No news for the month.

Upcoming catalysts include:

- 2022 – EIA permit due.

- 2023 – DFS due.

Critical Elements Lithium Corp. [TSXV:CRE] [GR:F12] (OTCQX:CRECF)

On May 13, Critical Elements Lithium Corp. announced:

Approval of the Rehabilitation and Restoration Plan concerning the Rose Lithium-Tantalum Mining Project. “We are very pleased with the decision regarding the rehabilitation and restoration plan for the Rose Lithium-Tantalum Project, which is a necessary step toward securing the mining lease,” stated Jean-Sébastien Lavallée, CEO of Critical Elements.

On May 17, Critical Elements Lithium Corp. announced:

Critical Elements successfully produces battery grade lithium hydroxide in pilot plant testing. The pilot plant conversion process from spodumene concentrate to lithium hydroxide was further optimized and confirmed the previous strong results with extraction and conversion rates of 92 %. In addition, the pilot plant produced battery grade lithium hydroxide…

Investors can view the company’s latest presentation here.

Upcoming catalysts include:

- 2022 – Rose Lithium-Tantalum Project provincial permitting. Possible off-take or financing announcements.

You can read the latest Trend Investing Critical Elements Lithium article here.

Lithium Power International [ASX:LPI] (OTC:LTHHF)

On April 29, Lithium Power International announced: “Activity report for the quarter ended March 2022.” Highlights include:

- “Positive results delivered in the updated Definitive Feasibility Study for the Stage One Maricunga Lithium Brine project: Maricunga Stage One DFS delivers US$1.4B NPV (after tax) at an 8% discount rate, providing an IRR of 39.6% and a two-year payback… Project direct development… a total project CAPEX of US$626M.

- Revised DFS completed…

- Preliminary indications of interest received from international and Chilean financial institutions and private funds for debt financing and future equity financing of the project. LPI’s financial advisers, Canaccord and Treadstone, are assisting with this process.

- Updating of the EPC proposals has commenced by two selected international engineering firms, Worley and Bechtel, with a final Investment Decision expected in Q4 2022. Construction is likely to start immediately after.

- LPI to spin-out its Western Australian Greenbushes and Pilgangoora lithium assets during the next six months. These interests are held by a wholly owned subsidiary of LPI, DemergeCo, which will seek to list on the ASX as Western Lithium Limited subject to ASX, ATO and shareholder approval.

- LPI shareholders to receive DemergeCo shares on a pro rata basis via a capital reduction and in-specie distribution, subject to shareholder and regulatory approvals.

- At the Blackwood Prospect at Greenbushes, an initial Ground Penetrating Radar survey and further soil sampling has been completed…”

Upcoming catalysts:

- 2022 – Further developments with Mitsui re off-take partner and funding announcements for Maricunga Lithium Brine Project in Chile. Spin-out of Western Australian Greenbushes and Pilgangoora lithium assets.

Lake Resources NL [ASX:LKE] [GR:LK1] (OTCQB:LLKKF)

Lake Resources own the Kachi Lithium Brine Project in Argentina. Lake has been working with Lilac Solutions Technology (private, and backed by Bill Gates) for direct lithium extraction and rapid lithium processing.

No significant news for the month.

ioneer Ltd [ASX:INR] [GR:4G1] (OTCPK:GSCCF)

ioneer Ltd. announced in September 2021 the sale of 50% of its flagship lithium boron project to Sibanye Stillwater for US$490m.

No news for the month.

Upcoming catalysts include:

- Any de

bt funding deals on top of the existing Sibanye-Stillwater US$490m to fund Rhyolite Ridge.

European Metals Holdings [ASX:EMH] [AIM:EMH] [GR:E861] (OTCPK:ERPNF) (OTCPK:EMHLF)(NASDAQ:OTCPK:EMHXY)

On May 12, European Metals Holdings announced: “European Metals commences trading on OTCQX® Best Market.” Highlights include:

- “European Metals accepted to trade on the globally renowned US based OTCQX® Best Market Platform.

- Company will commence trading on OTCQX® Best Market under the codes EMHXY, ERPNF and EMHLF on 12 May 2022.

- Trading will accelerate exposure to major US investors.

- OTCQX® Best Market adds to the Company’s suite of active listings across the ASX, AIM and European exchanges.”

Upcoming catalysts include:

- 2022 – Any off-take or project funding deals.

Galan Lithium [ASX:GLN]

Galan is developing their flagship Hombre Muerto West (“HMW”) Lithium Project located on the west side edge of the high grade, low impurity Hombre Muerto salar in Argentina. In total Galan Lithium has 3.0m tonnes contained LCE @858mg/L.

On April 29, Galan Lithium announced: “Quarterly activities report 31 March 2022.” Highlights include:

- “HMW Project DFS on budget and on schedule for completion by end CY2022.

- Two pumping boreholes completed at HMW with short term pumping tests successfully performed on both wells; third borehole due to commence.

- Diamond drillhole, PP-02-22, completed to a depth of 450m at Pata Pila licence; results confirm HMW Mineral Resource extends to the east at depth.

- Further exploration drilling of new HMW target zones to commence this quarter.

- HMW pilot plant S1 pond completed and full of brine; evaporation testing commenced.

- Completion of 7,622 km of airborne magnetic and radiometric geophysics survey at Greenbushes South.

- Pathfinder element concentrations from Greenbushes South soil samples and rock chips indicate prospective targets near the trace of the Donnybrook-Bridgetown Shear Zone…

- Exercised options deliver $2.2m cash injection.

- Cash and investments on hand at end of the quarter was $59.2m.”

Cypress Development Corp. (TSXV:CYP) (OTCQB:CYDVF)

Cypress Development owns tenements in the Clayton Valley, Nevada, USA.

On May 5, Cypress Development Corp. announced:

Cypress Development completes Enertopia asset acquisition… “The property is a continuation of the lithium bearing units in Cypress’ project, with Enertopia’s drilling having shown similar values of lithium. With this consolidation, the data will be incorporated into our resource model and has the potential to enhance the project through our Feasibility Study underway. We expect this consolidation of Clayton Valley lithium claystone projects to be of significant value for both Enertopia and Cypress shareholders.” The purchase consideration for the EnertopiaProject comprised US$1.1 million in cash and the issuance of 3,000,000 common shares in the capital of Cypress (“Consideration Shares”)…

Frontier Lithium [TSXV:FL] (OTCQX:LITOF)

Frontier Lithium own the PAK Lithium (spodumene) Project comprising 26,774 hectares and located 175 kilometers north of Red Lake in northwestern Ontario. The PAK deposit is a lithium-cesium-tantalum [LCT] type pegmatite containing high-purity, technical-grade spodumene (below 0.1% iron oxide).

On May 2, Frontier Lithium announced:

Frontier Lithium announces remaining 2022 exploration plans including a minimum of 15,000 meters of drilling and releases the results from channel sampling at the bolt pegmatite. Frontier Lithium is pleased to announce their 2022 exploration program and targets for the PAK Lithium Project (Project) in northwestern Ontario… The company plans to continue evaluating the Spark pegmatite recommencing mid-May by now utilizing two diamond drills over the 2022 exploration period. With a current measured and indicated resource of 21 Mt averaging 1.56 per cent Li2O and an additional inferred resource of 20 Mt averaging 1.48 per cent Li2O, it is anticipated that the drilling will result in increases in all resource categories of the deposit.

Firefinch Limited (ASX: FFX)(OTCPK:EEYMF)(lithium spinout 50/50 JV with Ganfeng Lithium named as Leo Lithium Limited to list on ASX soon)

On April 27, Firefinch Limited announced: “Quarterly Activities Report for period ending 31 st March 2022.” Highlights include:

Goulamina Lithium Project

- “All conditions precedent for Ganfeng’s investment into the Goulamina Project have now been met following transfer of the Goulamina Exploitation Licence.

- US$130 million in cash received by the joint venture company from Ganfeng and discussions advancing on the Ganfeng debt facility…

- Firefinch is proceeding with the demerger of Goulamina into Leo Lithium Limited in accordance with regulatory timeframes.”

Corporate

- “Cash and cash equivalents available of $102.09 million at 31 March, 2022.

- Simon Hay commenced as Leo Lithium Managing Director.”

On May 18, Firefinch Limited announced: “Morila convention extension granted.”

American Lithium Corp. [TSXV: LI] (OTCQB:LIACF) (acquired Plateau Energy Metals Inc.)

No news for the month.

Wealth Minerals [TSXV:WML] [GR:EJZN] (OTCQB:WMLLF)

Wealth Minerals has a portfolio of lithium assets in Chile, such as 46,200 Has at Atacama, 8,700 Has at Laguna Verde, 6,000 Has at Trinity, 10,500 Has at Five Salars. Also the right to acquire a 100% interest in the Ignace REE Lithium Pr

operty in Ontario, Canada.

On May 3, Wealth Minerals announced:

Wealth Minerals acquires additional ground in Ollagüe Salar. Wealth Minerals Ltd… reports the Company has signed an agreement with Lithium Chile Inc. (TSXV: LITH) (“Lithium Chile”) to acquire 1,600 hectares (“New Ollagüe Licenses”) adjacent and near-adjacent to its existing license position in the Ollagüe basin (the “Transaction”)…

Investors can view the company’s latest presentation here.

E3 Metals [TSXV:ETMC] (OTCPK:EEMMF)

E3 Metals is a lithium development company focused on commercializing its extraction technology and advancing the world’s 7th largest lithium resource with operations in Alberta. E3 has an inferred mineral resource of 6.7 million LCE.

On May 12, E3 Metals announced: “E3 Metals Corp announces filing of first quarter 2022 financial statements and MD&A.”

You can read the company’s latest presentation here.

Iconic Minerals [TSXV:ICM] [FSE:YQGB] (OTCPK:BVTEF)/ Nevada Lithium Corp. [CSE: NVLH]

Joint Venture (Nevada Lithium Corp. earn in option to 50%) in the Bonnie Claire Project in Nevada, USA; with an Inferred Resource of 18.68 million tonnes LCE.

On April 28, Iconic Minerals announced:

Iconic Minerals upgrades to OTCQB Venture Market. Iconic Mineral’s CEO, Richard Kern stated, “We are pleased that upgrading to the OTCQB Venture Market will allow Iconic the ability to continue to improve greater awareness for our current, and potential shareholders, while we advance towards completing our pre-feasibility study on the Bonnie Claire lithium property.”

On May 4, Iconic Minerals announced:

Iconic announces plan of operation for Bonnie Claire Lithium Project declared complete by BLM… Iconic is also pleased to announce that it has initiated its 2022 exploration program at Bonnie Claire. The Company is currently improving roads, setting up water storage and moving supplies and machinery to the project. The first drill hole of the year will commence in approximately one week. This year’s drilling will further define the resource, provide additional metallurgical samples, and initiate borehole mining testing required for the Prefeasibility Study.

Arena Minerals [TSXV:AN] (OTCPK:AMRZF)

On May 19, Arena Minerals announced:

Arena Minerals reports pond construction is underway and provides project update. Arena Minerals Inc. is pleased to announce evaporation pond construction is underway at its Sal de la Puna Project (“SDLP Project”) located in the Pastos Grandes basin within Salta province, Argentina. The evaporation pilot pond shall cover a total of 10,000 m2; designed to produce >35% lithium chloride (“LiCl”) (6% lithium) from SDLP raw brine…

On May 24, Arena Minerals announced:

Arena Minerals enters collaboration agreement with Lithium Americas. The intention of the Collaboration Agreement is to share technical information and explore opportunities for collaborating on potential development alternatives with the overall objective of optimizing the production profile of the Pastos Grandes basin…

Rio Tinto [ASX:RIO] [LN:RIO] (RIO)

On May 5, Reuters reported: “Rio Tinto keen for talks to revive Serbian lithium project.” Highlights include:

- “Serbia blocked mine after mass environmental protests.

- Rio says Jadar has “impeccable” environmental credentials.

- Rio says Jadar offers big economic opportunity for Serbia.”

Lithium South Development Corp. [TSXV:LIS] (OTCQB:LISMF)

On April 26, Lithium South Development Corp. announced:

Lithium South drill program to begin at Alba Sabrina claim block. The Company has retained Servicios Geologicos of Salta, Argentina, to conduct a 2,000-meter core hole drill program on the Alba Sabrina claim block. At 2,089 hectares, the Alba Sabrina claim block is the largest of the nine block, 5,687-hectare project. A recent TEM Study (See October 4, 2021, press release) has identified a surficial halite aquifer of approximately 75 meters of depth, with a clastic brine aquifer immediately below. The TEM Study was limited to approximately 350 meters of depth, with the basement rock not confirmed. The drill program will attempt to drill to basement, limited to approximately 700 meters by the depth potential of the drill rig. The drill rig is expected to be located on site within the next two weeks.

On May 11, Lithium South Development Corp. announced: “Lithium South retains groundwater insight for resource calculation…”

Alpha Lithium [TSXV:ALLI][GR:2P62] (OTCPK:APHLF)

No news for the month.

International Lithium Corp. [TSXV:ILC] (OTCPK:ILHMF)

No news for the month.

Lithium Energy Limited [ASX:LEL]

On April 27, Lithium Energy Limited announced: “EIA approvals now granted for all Solaroz Lithium Project concessions – Exploration underway.”

On May 9, Lithium Energy Limited announced:

Geophysics expanded across all concessions to refine drill targets at Solaroz Lithium Project… In the process of finalising arrangements with drilling contractors for a ~5,000 metre drilling programme to commence after the TEM surveys are completed.

Argentina Lithium & Energy Corp. [TSXV: LIT] (OTCQB:PNXLF)

On May 2, Argentina Lithium announced:

Argentina Lithium geophysics delineates potential extent of conductive brine aquifers at Rincon West.

Avalon Advanced Materials [TSX:AVL] [GR:OU5] (OTCQX:AVLNF)

Avalon has three projects in Ontario, Canada, and five in total throughout Canada. Avalon’s most advanced project is the Separation Rapids Lithium Project in Ontario with a M& I Resource estimate of the 8.2MT at 1.37% Li2O and 0.36% Rb2O plus Inferred 1.2MT at 1.33% Li2O and 0.361% Rb2O. Avalon is working on a plan for a JV to build a lithium-ion battery materials refinery in Thunder Bay, Ontario.

On May 5, Avalon Advanced Materials announced:

Avalon enters into $3,000,000 convertible Security Funding Agreement to accelerate separation rapids lithium work…

Essential Metals [ASX:ESS] (OTCPK:PIONF)

Essential Metals has 9 projects (lithium, gold, gold JV, and nickel JV) all in Western Australia. Their flagship Pioneer Dome Lithium (spodumene) Project has a JORC Compliant Total Resource of 11.2Mt at 1.21% Li2O.

On April 29, Essential Metals announced: “March 2022 quarterly report.” Highlights include:

- “Pioneer Dome Lithium Project, WA… The programme will consist of 22 Reverse Circulation + diamond tail (RCD) holes totalling 9,000m. Assay batches from the air-core drill programme completed in January remain outstanding and are now expected in May. A report on all results will be finalised in June. Baseline environmental survey report and hydrology report finalised during the Quarter.

- Juglah Dome Gold Project, WA: A 22-hole RC drill programme totalling 1,915 metres was completed during the Quarter with assays due by the end of May. Felsic porphyry with variable feldspar-pyrite alteration and quartz veining was observed in every drill line.

- Closing cash on hand as at 31 March 2022 was $9.5 million.

- Post quarter: An unsolicited, confidential, non-binding indicative takeover proposal was received from a credible lithium industry participant to acquire 100% of the issued capital of Essential by way of an off-market takeover, however it was subsequently withdrawn in light of the recent upward trajectory in the trading price of Essential shares.”

Green Technology Metals [ASX: GT1]

Green Technology Metals [ASX:GT1] (“GT1”) has several very promising lithium projects near Thunder Bay in Ontario, Canada. The current JORC Total Mineral Resource is 4.8Mt @ 1.25% with a projects (spodumene) wide target resource of 50-60 MT @ 0.8-1.5% Li2O.

On April 28, Green Technology Metals announced: “Strategic investment from Lithium Americas Corp. and A$55m equity raising.” Highlights include:

- “Firm commitments received for two-tranche equity placement to raise A$55 million.

- Includes strategic investment of US$10M (A$14M) by major North American lithium industry proponent, Lithium Americas Corp. (TSX/NYSE:LAC).

- Placement strongly supported by a wide range of leading Australian and international institutional and sophisticated investors.

- Funds to be primarily directed towards aggressive exploration and advancement of GT1’s key lithium assets in Ontario, including completion of an Integrated Feasibility Study for the flagship Seymour Lithium Mine Project.

- Non-binding Collaboration Framework established with LAC to assess a strategically located, integrated lithium chemicals business in North America.”

On April 29, Green Technology Metals announced: “Quarterly activities report for the quarter ended 31 march 2022.” Highlights include:

- “North Aubry lithium deposit at Seymour returned thick, maiden GT1 intercept of 40m @ 1.54% Li2O.

- North Aubry lithium deposit extended down dip and along strike with further thick, high-grade intercepts.

- Strategic lithium footprint in Ontario expanded from 9,467 Ha to approx. 40,000 Ha.

- Central Aubry and Pye drilling at Seymou

r commenced with second diamond rig. - GT1 increases ownership to 80% of the Ontario Lithium Projects.

- Cash balance of A$16.1M at quarter end; A$55M equity raising completed in late April.”

On May 19, Green Technology Metals announced: “Further significant step-out intercepts returned at Seymour.” Highlights include:

- “Assays received for further seven holes from Phase 1 step-out diamond drilling of North Aubry deposit at GT1’s flagship Seymour Lithium Project.

- Additional thick, high-grade extensional intercepts of North Aubry deposit including: GTDD-22-0001 for 10.5m @ 1.77% Li2O from 123.2m (incl. 7.0m @ 2.11% Li2O). GTDD-22-0013 for 18.2m @ 1.10% Li2O from 304.2m (incl. 3.1m @ 2.05% Li2O). GTDD-22-0014 for 4.5m @ 0.61% Li2O from 250.7m (incl. 2.5m @ 1.01% Li2O)

- Further northern step-out drilling of North Aubry deposit commenced; hole GTDD-22-0320 intercepts 10.7m of pegmatite with significant visible spodumene (assays pending), extending the known North Aubry pegmatite a further 150m down-dip from the nearest intercept.

- Results from Phase 1 drilling (assays now returned for all 16 holes) indicate substantial potential upside to existing Seymour Mineral Resource estimate of 4.8 Mt @ 1.25% Li2O1.

- Updated Mineral Resource estimate for Seymour on track for completion during Q2 CY2022.

- No significant lithium intercepts >1.0% Li20 were returned from initial exploration drilling of the eastern Central Aubry zone (7 holes) and Pye prospect (6 holes).

- Drilling is targeted to resume from June at both Central Aubry (western) and Pye (targeting LCT-type pegmatites of over 250m strike that were identified in the initial drilling).”

Battery recycling, lithium processing and new cathode technologies

Rock Tech Lithium [CVE:RCK](OTCQX:RCKTF)

On May 11, Rock Tech Lithium announced: “Rock Tech Lithium joins the European Battery Alliance.”

Neometals (OTC:RRSSF) (Nasdaq:RDRUY) [ASX:NMT]

On April 29, Neometals announced: “Quarterly activities report for the quarter ended 31 March 2022.” Highlights include:

“Corporate

- Cash balance A$65.2 million, receivables and investments of A$46.5 million and no debt.

- Neometals shares admitted to trading on the AIM market of the London Stock Exchange.

…Lithium-ion Battery (“LIB”) Recycling Project (50% NMT via Primobius GmbH, an incorporated JV with SMS group GmbH)…

Lithium Chemicals Project (earning into 50:50 JV with Bondalti Chemicals SA via Reed Advanced Materials Pty Ltd (“RAM”) (NMT 70:30 Mineral Resources Ltd)…”

On May 13, Neometals announced: “Primobius executes cooperation agreement with Mercedes-Benz.”

Nano One Materials (TSX: NANO) (OTCPK:NNOMF)

On May 25 Nano One announced:

Nano One to acquire Johnson Matthey Battery Materials Canada… JMBM Canada includes a team with over 360 years of collective experience, including R&D, pilot to commercial scale cathode production and product qualification and quality assurance systems expertise for tier 1 automotive lithium-ion cell manufacturers. JMBM Canada also includes a 2,400 tonne per annum capacity LFP production facility located in Candiac, Québec…

Other lithium juniors

Other juniors include: 5E Advanced Materials Inc [ASX:5EA] (FEAM), American Lithium Minerals Inc. (OTCPK:AMLM), Anson Resources [ASX:ASN] [GR:9MY], Ardiden [ASX:ADV], Arizona Lithium [ASX:AZL] (AZLAF), Atlantic Lithium [LON:ALL] (OTCPK:ALLIF), Bradda Head Lithium Limited [LON:BHL] (BHLIF) (OTCPK:CDCZF), Bryah Resources Ltd [ASX:BYH], Carnaby Resources Ltd [ASX:CNB], Critical Resources [ASX:CRR], Electric Royalties [TSXV:ELEC], Eramet [FR: ERA] (OTCPK:ERMAF) (OTCPK:ERMAY), European Lithium Ltd [ASX:EUR] (OTCPK:EULIF), Foremost Lithium Resources & Technology [CSE:FAT] (OTCPK:FRRSF), Greenwing Resources Limited [ASX:GW1] (OTCPK:BSSMF), HeliosX Lithium & Technologies Corp. [TSXV:HX] (formerly Dajin Lithium Corp. [TSXV:DJI]), Hannans Ltd [ASX:HNR], Infinity Lithium [ASX:INF], International Battery Metals [CSE: IBAT] (OTCPK:IBATF), Ion Energy [TSXV:ION], Jadar Resources Limited [ASX:JDR], Kodal Minerals (LSE-AIM: KOD), Larvotto Resources [ASX:LRV], Latin Resources Ltd [ASX:LRS] (OTC:LAXXF), Lepidico [ASX:LPD] (OTCPK:LPDNF), Liberty One Lithium Corp. [TSXV:LBY] (OTCPK:LRTTF), Lithium Australia [ASX:LIT] (OTC:LMMFF), Lithium Chile Inc. [TSXV:LITH][GR:KC3] (OTCPK:LTMCF), Lithium Corp. (OTCQB:LTUM), Lithium Energi Exploration Inc. [TSXV:LEXI](OTCPK:LXENF), Lithium Plus Minerals [ASX:LPM], Metals Australia [ASX:MLS], MetalsTech [ASX:MTC], MinRex Resources [ASX:MRR], MGX Minerals [CSE:XMG] (OTC:MGXMF), New Age Metals [TSXV:NAM] (OTCQB:NMTLF), Noram Lithium Corp. [TSXV:NRM] (OTCQB:NRVTF), One World Lithium [CSE:OWLI] (OTC:OWRDF), Patriot Battery Metals [CSE:PMET] (OTCQB:PMETF), Portofino Resources Inc.[TSXV:POR] [GR:POT], Power Metals Corp. [TSXV:PWM] (OTCPK:PWRMF), Prospect Resources [ASX:PSC], Pure Energy Minerals [TSXV:PE] (OTCQB:PEMIF), Quantum Minerals Corp. [TSXV:QMC] (OTCPK:QMCQF), Snow Lake Lithium (LITM), Spearmint Resources Inc [CSE:SPMT] (OTCPK:SPMTF), Surge Battery Metals Inc. [TSXV:NILI] (OTCPK:NILIF), Ultra Lithium Inc. [TSXV:ULI] (OTCQB:ULTXF), United Lithium Corp. [CSE:ULTH] [FWB:0UL] (OTCPK:ULTHF), Vision Lithium Inc. [TSXV:VLI] (OTCQB:ABEPF), Winsome Resources Limited [ASX:WR1], Zinnwald Lithium [LN:ZNWD].

Conclusion

May saw lithium chemicals prices only slightly lower and spodumene prices continued to rise strongly.

Highlights for the month were:

- Canada in ‘active discussions’ with EV supply chain companies – minister.

- Update to Defense Production Act: US now expands definition of “domestic source” of battery raw materials to include UK, Australia and Canada.

- Chile’s constitutional assembly rejects plans to nationalise parts of mining sector.

- BMI global gigafactory pipeline at 304. There is now a 6,387.6 GWh pipeline of battery capacity.

- Sayona Mining positive Pre‐feasibility Study enhances NAL value. New lithium pegmatite discovery at Moblan, potential for expanded resource.

- Liontown Resources and LG Energy Solution execute binding Offtake Agreement.

- AVZ Minerals – Chinese, Aust

ralian investors battle for largest lithium deposit. - Global Lithium Resources announces Mineral Resources Limited becomes a strategic cornerstone investor with a 5% interest.

- Critical Elements successfully produces battery grade lithium hydroxide in pilot plant testing.

- Cypress Development Corp. completes Enertopia asset acquisition.

- Firefinch is proceeding with demerger of Goulamina into Leo Lithium Ltd.

- Wealth Minerals acquires additional ground in Ollagüe Salar.

- Arena Minerals reports pond construction is underway at its Sal de la Puna Project, enters collaboration agreement with Lithium Americas.

- Rio Tinto keen for talks to revive Serbian lithium project.

- Lithium South drill program to begin at Alba Sabrina claim block.

- Lithium Energy Limited EIA approvals now granted for all Solaroz Lithium Project concessions, ~5,000 metre drilling programme to begin after the TEM surveys are completed.

- Argentina Lithium geophysics delineates potential extent of conductive brine aquifers at Rincon West.

- Essential Metals received a non-binding indicative takeover proposal that was subsequently withdrawn.

- Green Technology Metals raising $50m; Lithium Americas buys in. Results from Phase 1 drilling indicate substantial potential upside to existing Seymour Mineral Resource estimate of 4.8 Mt @ 1.25% Li2O.

- Neometals announced Primobius executes cooperation agreement with Mercedes-Benz.

- Nano One to acquire Johnson Matthey Battery Materials Canada.

As usual all comments are welcome.