Regardless of fears of inflation, supply chain challenges, skyrocketing strength and household prices, and global instability prompted by the Ukraine disaster, chief facts officers and facts technologies consumers proceed to expect in general investing to boost additional than 6% in 2022.

Although this is reduced than our 8% prediction made in January of this calendar year, it stays in line with previous year’s about 6% to 7% expansion and is keeping company with the anticipations reported by tech executives previous quarter.

In this Breaking Examination, we update you on our most current seem at tech shelling out with a preliminary take from ETR’s most up-to-date macro drill-down study. We’ll share some insights as to which sellers have revealed the most significant change in expending trajectory and inquire the technical analysts in our neighborhood to give us a study on what they assume it usually means for technology shares heading forward.

Shelling out sentiment between IT customers remains solid

In the earlier two months we’ve had discussions with dozens of CIOs, chief details officers, facts executives, IT supervisors and application builders. Across the board they’ve indicated that, for now at the very least, their expending degrees continue to be mainly unchanged. The most current ETR drill-down info, which we’ll share shortly, confirms these anecdotal checks.

On the other hand, the interpretation of this knowledge is nuanced. Part of the reason for the paying amounts are keeping up is inflation. Stuff costs a lot more so spending stages are bigger, forcing IT administrators to prioritize. Protection continues to be the No. 1 precedence and is much less inclined to cuts. Cloud migration, efficiency initiatives and knowledge tasks continue being prime priorities.

So in which are CIOs robbing from Peter to pay back Paul? We’ve noticed a slight uptick in certain speculative IT tasks remaining place on maintain and, according to ETR study data, we have witnessed some choosing freezes described, in particular noteworthy in the health care sector.

Seller consolidation is the most-cited savings tactic

ETR also surveyed its buyer foundation to discover out the place they were modifying their budgets. Consolidating IT distributors was by significantly the most cited tactic. This can make perception as corporations, in an exertion to negotiate far better offers, will generally forgo investments in newer most effective of breed technologies and bundle in items and providers from more substantial suppliers, even although they may possibly not be as useful.

ETR survey respondents also cited chopping the cloud invoice where discretionary paying out was in perform. We surely noticed this with some of the biggest Snowflake Inc. customers this past quarter where by even although they were still growing consumption speedily, specific customers dialed down their usage and pushed investing off to future quarters. Recall, in the scenario of Snowflake anyway, buyers negotiate intake rates dependent on a total dedication above a interval of time. So despite the fact that they may possibly consume fewer in just one quarter, above the life time of the deal, Snowflake (and a number of other cloud organizations) have superior visibility on the life span price of a deal.

Customers count on investing stages to keep on being secure (for now)

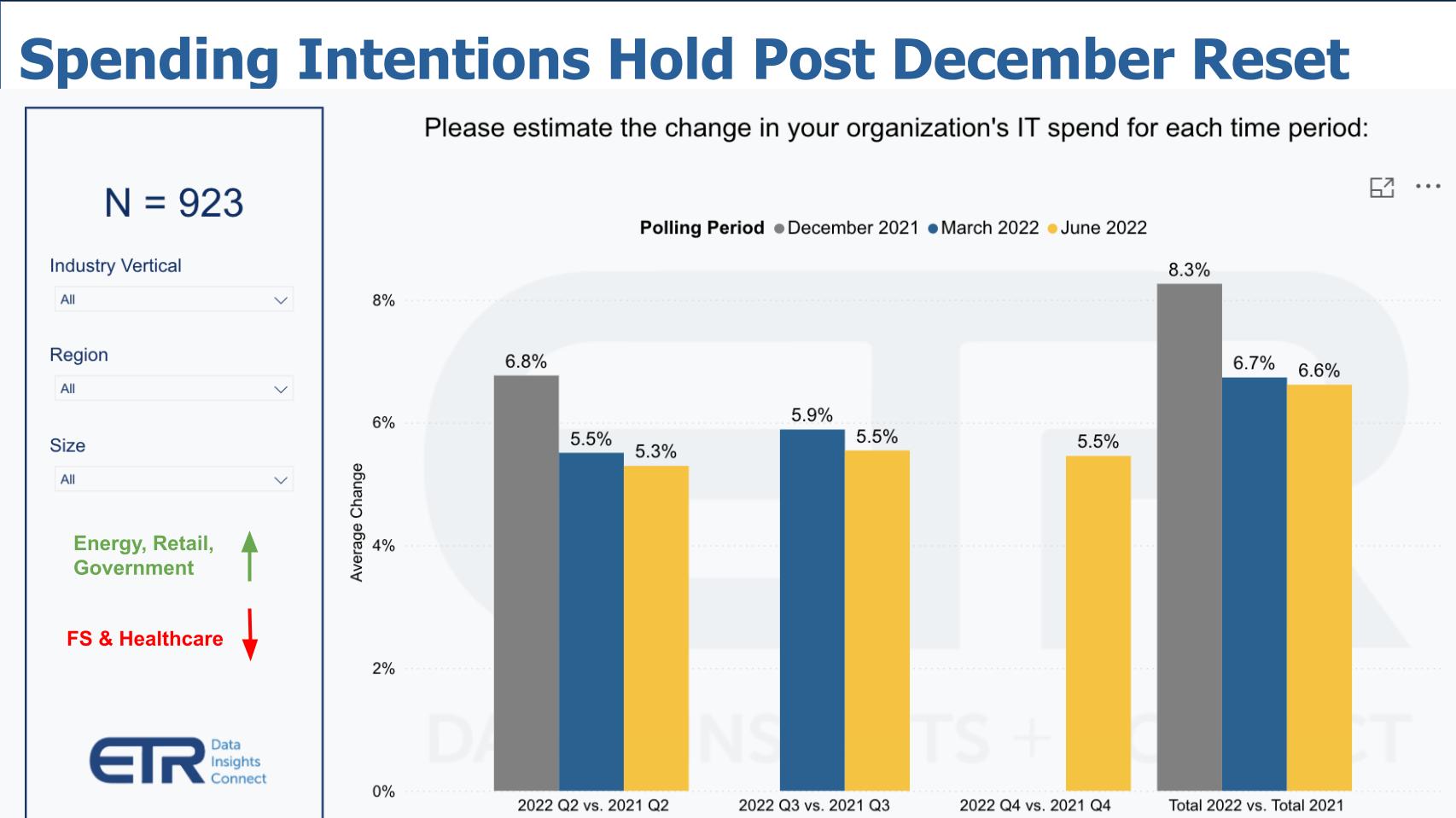

The chart above shows the most recent ETR investing expectations among much more than 900 respondents. The bars represent paying out progress expectations from the periods of December 2021 (gray bars) the March of 2022 study (blue) and the most new June info (yellow).

You can see the expectation for investing in the quarter is down somewhat in the mid 5% vary but over-all for the 12 months, anticipations continue to be in the mid-6% degrees. This figure is down from 8%+ in December, in which it seemed like 2022 was heading to have additional momentum than even very last yr. Remember this was ahead of Russia invaded Ukraine, which occurred in mid-February of this calendar year.

Typically speaking, CIOs have advised us that their chief economical officers have decreased their earnings outlooks for Wall Avenue. They’ve informed us that unless and until these revised forecasts look at threat, they continue to be expecting their shelling out degrees to remain very constant.

A good deal of spending momentum on certain vendor platforms: Safety companies direct the pack

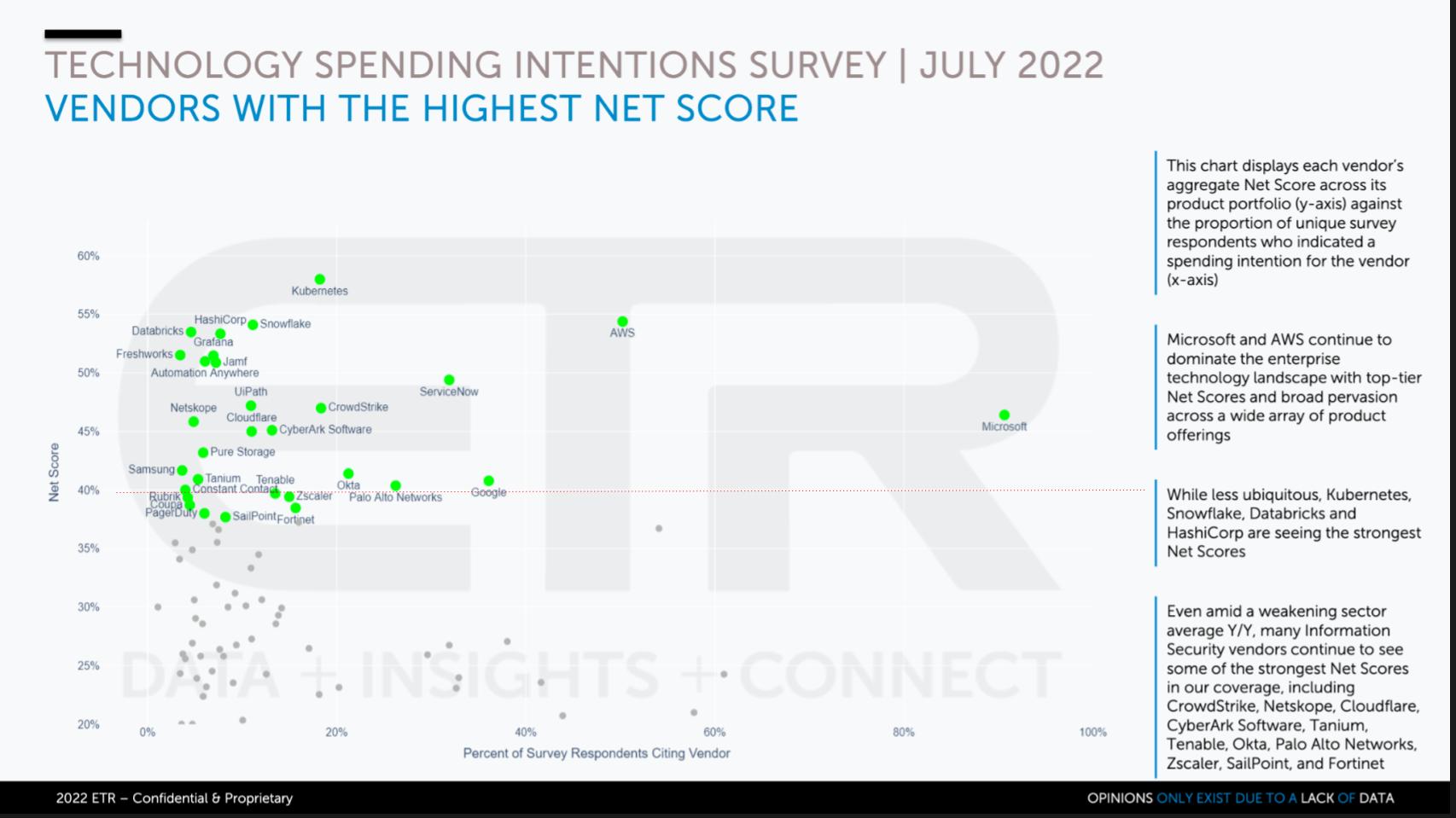

The chart earlier mentioned exhibits the providers with the biggest investing momentum as measured by ETR’s proprietary Web Score methodology. Internet Rating steps the internet share of consumers paying more on a certain platform. That measurement is proven on the Y axis. The crimson line inserted at 40% is a remarkably elevated marker and the inexperienced dots are providers in the ETR survey that are in close proximity to or over that line. The X axis actions the presence or pervasiveness in the info set.

Now, of course, Kubernetes is not a enterprise but it continues to be an region in which companies are paying heaps of resources and time – specially to modernize and mobilize applications. Snowflake stays the organization that prospects all firms in paying out velocity, but as you will see momentarily, even with its maximum place, it’s down from prior levels in the superior 70% to the reduced 80% selection.

Amazon Website Providers Inc. is exceptionally remarkable due to the fact it has an elevated stage but also a massive existence in the survey. Very same with Microsoft Corp. Exact with ServiceNow Inc., which stands out. And you can see the other lesser distributors these as HashiCorp, which is more and more getting observed as a cross-cloud enabler, demonstrating elevated investing momentum. The robotic course of action automation vendors, Automation Anyplace Inc. and UiPath Inc., are in elevated territory. But it is the protection businesses that genuinely stand out. CrowdStrike Holdings Inc., CyberArk Inc., Netskope Inc., Cloudflare Inc., Tenable Inc., Okta Inc., Zscaler Inc., Palo Alto Networks Inc., SailPoint Technologies Holdings Inc. and Fortinet Inc. are all displaying elevated ranges with quite a few cybersecurity companies hovering at or earlier mentioned the 40% mark.

Pure Storage Inc. stays elevated, as do PagerDuty Inc. and Coupa Software Inc.

There is plenty of fantastic information here in spite of the tech crash.

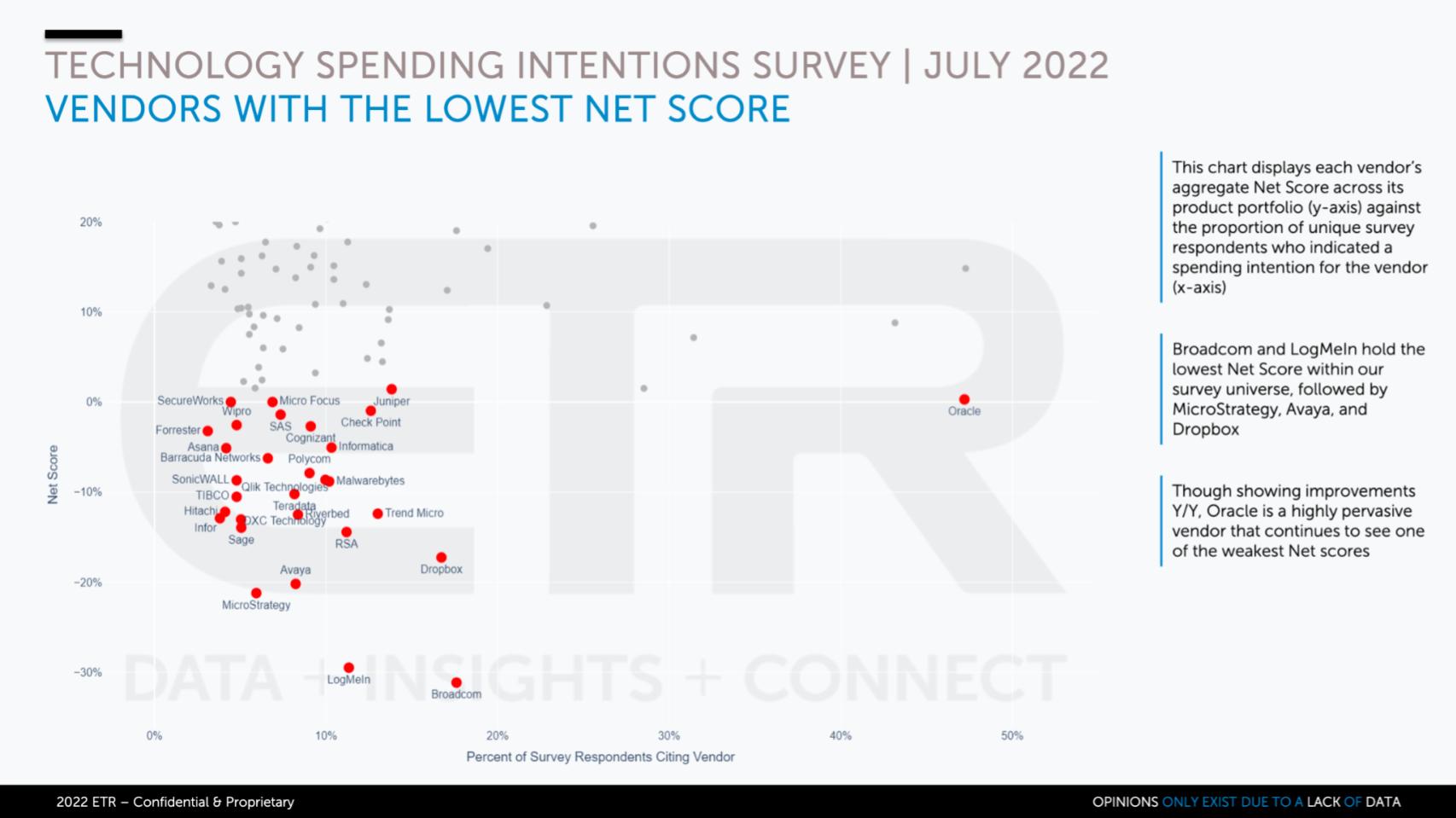

Now for the red staff

There is no 40% line on the over chart for the reason that all these organizations are well under that line. Now this does not suggest these companies are lousy organizations. It just indicates that a higher quantity of firms in the ETR study are paying much less than a lot more on the certain company’s solutions and expert services. In other words and phrases, they really don’t have the expending velocity of the kinds we confirmed previously.

A fantastic illustration is Oracle Corp.: Search how it stands out on the X axis with a large marketplace presence. Inspite of its lower Web Rating, Oracle continues to be an exceptionally thriving enterprise marketing to significant-conclude prospects and owning the mission-vital knowledge and purposes marketplaces. And keep in mind, ETR actions spending action but not genuine bucks. So companies this sort of as Oracle, with significant-spending budget clients, are not rewarded in the ETR surveys. However, the fact remains that Oracle has a big legacy put in foundation that pulls down its advancement costs, which ETR does capture.

Broadcom Inc. is one more example. It’s a single of the most productive providers in the industry. It’s not heading immediately after expansion at all prices. It’s going just after EBITDA, earnings ahead of curiosity, taxes, depreciation and amortization, which ETR doesn’t measure.

So just continue to keep that in head as you look at this details.

How is investing velocity switching above time?

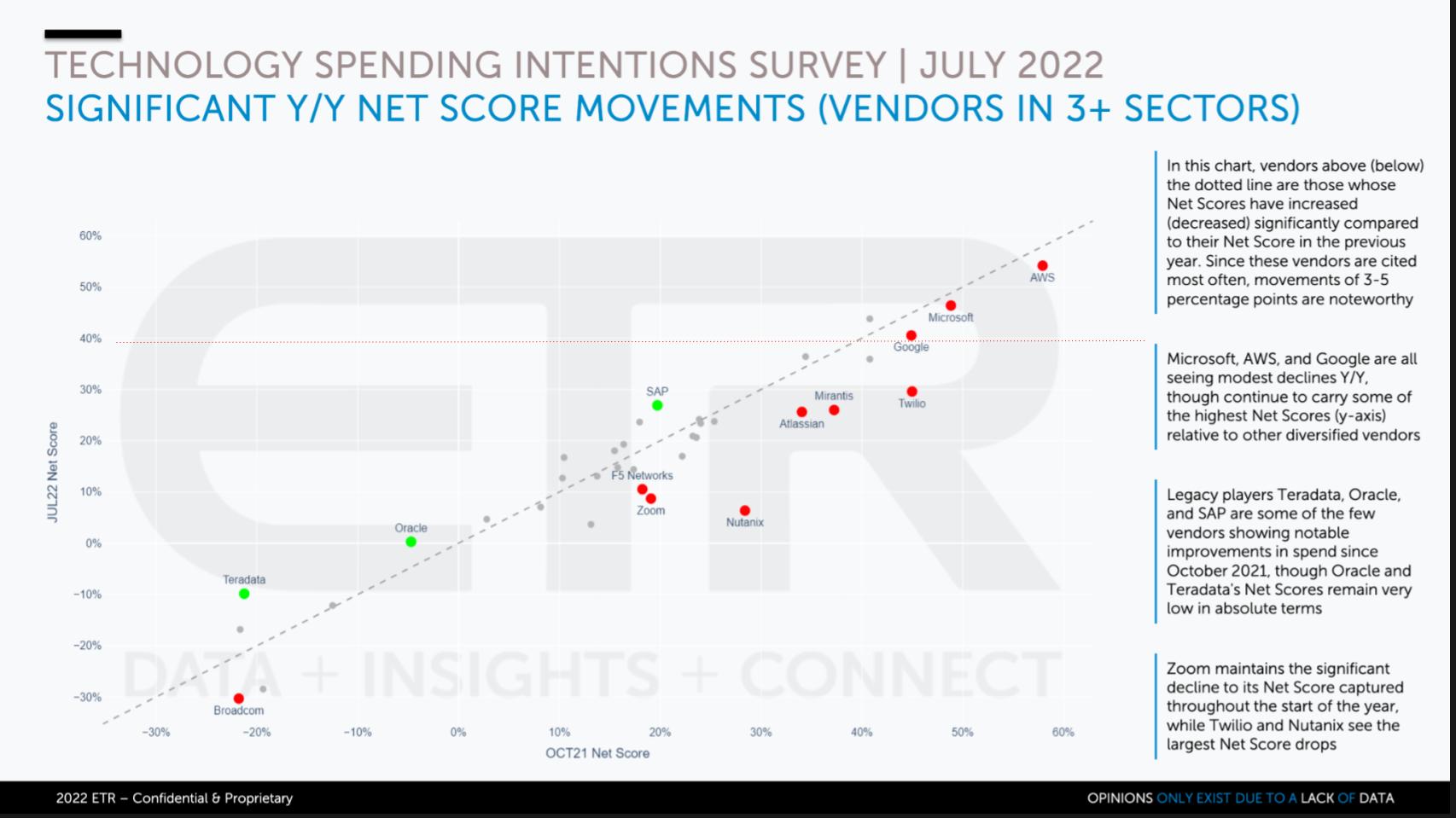

The chart higher than exhibits the year-over-12 months Net Score improve for distributors that take part in at minimum 3 sectors inside the ETR taxonomy. Names earlier mentioned or underneath the gray dotted line are these businesses wherever the Net Score has increased or lowered.

Placing this in context with the before chart, it’s all relative, right? Oracle, although obtaining decreased Net Scores has also demonstrated a extra significant enhancement than some of the some others, as have SAP SE and Teradata Corp.

What’s extraordinary here is how AWS, Microsoft and Google LLC are in fact keeping the line really properly. The other ironically fascinating two info details listed here are Broadcom and Nutanix Inc. Broadcom is purchasing VMware Inc. and of training course most buyers are anxious about getting strike with increased selling prices. Nutanix, even with its alter in Internet Score, is in a good place to capture some of that VMware business. Just yesterday we talked to a customer who explained to us he migrated his entire portfolio off VMware, using Nutanix AHV, in an hard work to prevent the “V-Tax.”

Now, this was a more compact client and not representative of what we consider is Broadcom’s excellent customer profile. But Nutanix should really advantage from the Broadcom acquisition if it can placement itself to pick up the company Broadcom doesn’t want.

Just one person’s trash is another’s treasure….

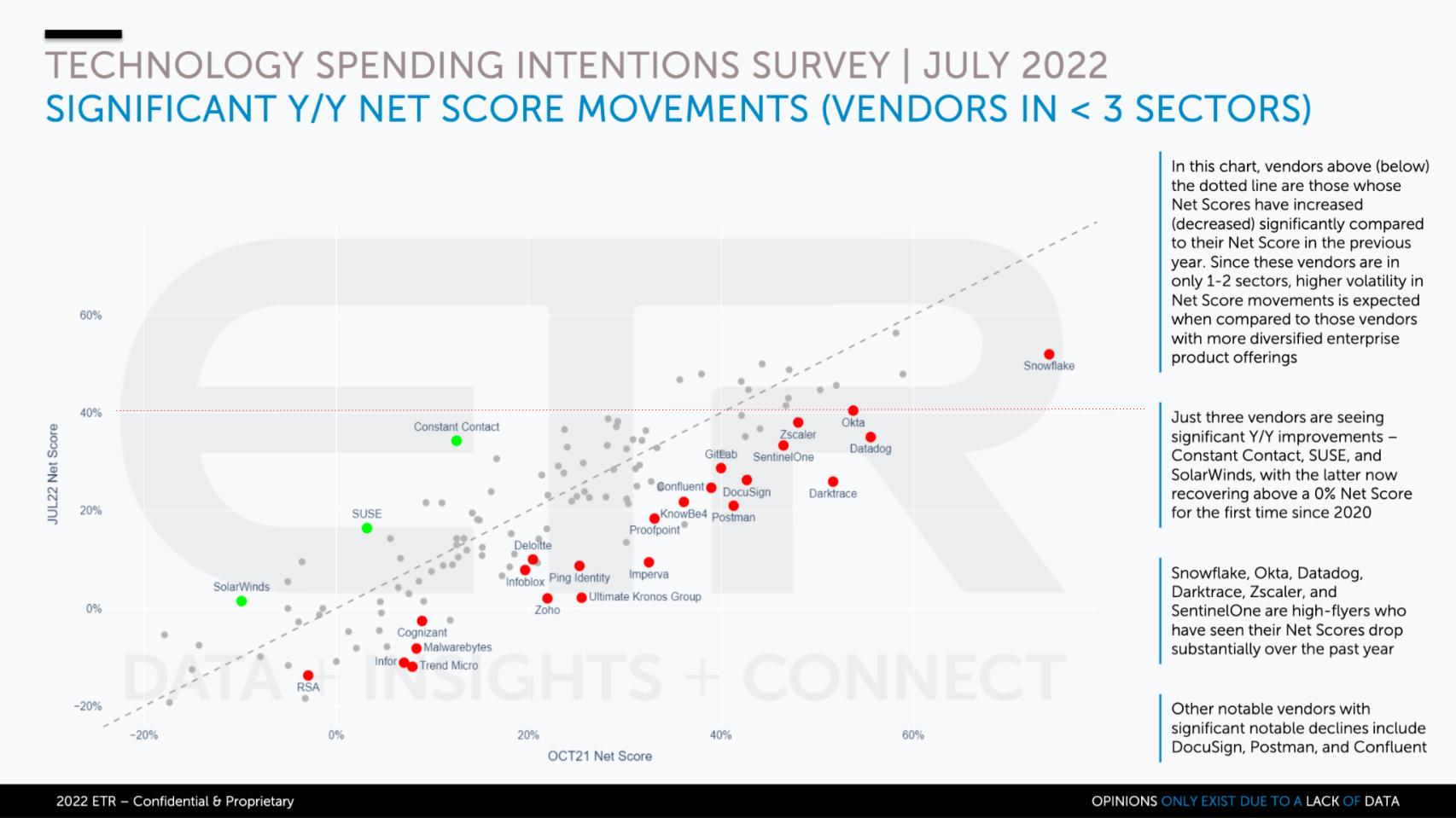

Adjust in shelling out velocity for ‘pure play’ corporations

Over is the similar chart as the former a single for providers that take part in two or fewer segments inside the ETR taxonomy.

Only three names are observing positive movement calendar year around calendar year in Web Score. SUSE Group, underneath the energizing management of Melissa Di Donato, is building moves. It went general public previous 12 months and acquired Rancher Labs Inc. in 2020. We know Pink Hat is the large canine in Kubernetes but considering the fact that the IBM Corp. acquisition, but people today have looked to SUSE as a likely alternate and it’s showing in the quantities. SUSE has a pleasant business enterprise and will do far more than $600 million in revenue this 12 months with stable double-digit development. Its profitability is less than force, but it is surely a player that has identified a area of interest and is worth looking at.

SolarWinds Worldwide LLC is probably a little bit of a lifeless cat bounce coming off the major breach – some of its customers just can not go off the system.

In that sea of purple dots, there are many large-value-to-earnings ratio stocks – or infinite PE shares that have no E – and we can see how their Internet Scores have dropped. We have claimed extensively on Snowflake Inc. – nevertheless No. 1 in Web Score but large moves off its highs. Okta, Datadog Inc., Zscaler, SentinelOne Inc. and Dynatrace Inc. all exhibiting big downward moves alongside with the rest. So this chart actually speaks to the modify in expectations from the COVID bubble, despite the simple fact that many of these company’s CFOs would inform you the pandemic wasn’t essentially a tailwind for them.

Bear industry rally, time to get or making a foundation: What do the professionals feel?

The significant question on people’s minds is: What is heading to transpire to these tech businesses in the stock market place?

We arrived at out to both equally Erik Bradley of ETR, who used to be a technological analyst on Wall Street, and to longtime trader and recurrent Breaking Analysis contributor Chip Symington to get a go through on what they imagined.

The initial observation is the current market has been off 11 out of the past 12 weeks and bear current market rallies like what we’re seeing right now take place from time to time.

Federal Reserve Chairman Jerome Powell’s testimony was considered positively by the Avenue for the reason that greater curiosity prices are envisioned to push commodity charges down and weaken consumer sentiment, which may possibly stage to a much less onerous inflation outlook.

Symington pointed out to Breaking Examination awhile back that the Nasdaq index has been on a development line for the earlier six months exactly where its highs are decrease and the lows are reduce and we’re bumping up towards that development line at these degrees. What he implies is if it breaks that development it could be a shopping for sign as he feels that tech stocks are oversold.

He pointed to a recent and significantly-wanted bounce in semiconductors and cited the Qualcomm Inc. example. Here’s a business trading at 12 instances forward earnings with a sustained 14% growth amount and hard cash move to guidance its 2.42% yearly dividend.

So in general he feels this rally was predicted. He’s cautious because we’re still in a bear market place but he’s commencing to switch bullish.

Erik Bradley extra that he feels the market is creating a foundation right here and he doesn’t anticipate a 1970s-80s yearlong sideways shift since of all the cash that’s nevertheless in the procedure. But it could bounce about for numerous months and, with larger desire rates, there will be more choices other than equities, which for many several years hasn’t been the situation.

Of course inflation and recession are like two looming towers that we’re all seeing closely and will in the end establish if, when and how this market place turns about.

As often, we’ll be listed here seeing the facts and reporting content variations to our group.

Keep in touch

Thanks to Stephanie Chan, who researches subjects for this Breaking Investigation. Alex Myerson is on production, the podcasts and media workflows. Distinctive many thanks to Kristen Martin and Cheryl Knight, who enable us preserve our neighborhood knowledgeable and get the phrase out, and to Rob Hof, our editor in main at SiliconANGLE. And specific thanks this 7 days to Andrew Frick, Steven Conti, Anderson Hill, Sara Kinney and the entire Palo Alto staff.

Remember we publish every week on Wikibon and SiliconANGLE. These episodes are all available as podcasts where ever you listen.

Email [email protected], DM @dvellante on Twitter and comment on our LinkedIn posts.

Also, test out this ETR Tutorial we made, which clarifies the paying out methodology in far more depth. Note: ETR is a separate business from Wikibon and SiliconANGLE. If you would like to cite or republish any of the company’s facts, or inquire about its expert services, remember to make contact with ETR at [email protected].

Here’s the entire video assessment:

https://www.youtube.com/look at?v=xhH6CmXfGBc

All statements manufactured pertaining to organizations or securities are strictly beliefs, points of watch and viewpoints held by SiliconANGLE Media, Enterprise Technologies Investigation, other friends on theCUBE and visitor writers. Such statements are not recommendations by these persons to get, sell or maintain any protection. The articles introduced does not constitute expense suggestions and should not be applied as the foundation for any expenditure decision. You and only you are dependable for your financial investment decisions.

Disclosure: Several of the firms cited in Breaking Investigation are sponsors of theCUBE or shoppers of Wikibon. None of these firms or other organizations have any editorial control over or highly developed viewing of what is posted in Breaking Evaluation.