Inspite of a blended bag of earnings stories from tech firms not long ago, a fall in gross domestic merchandise this earlier quarter and growing inflation, the cloud continues its relentless expansion on the information technologies landscape.

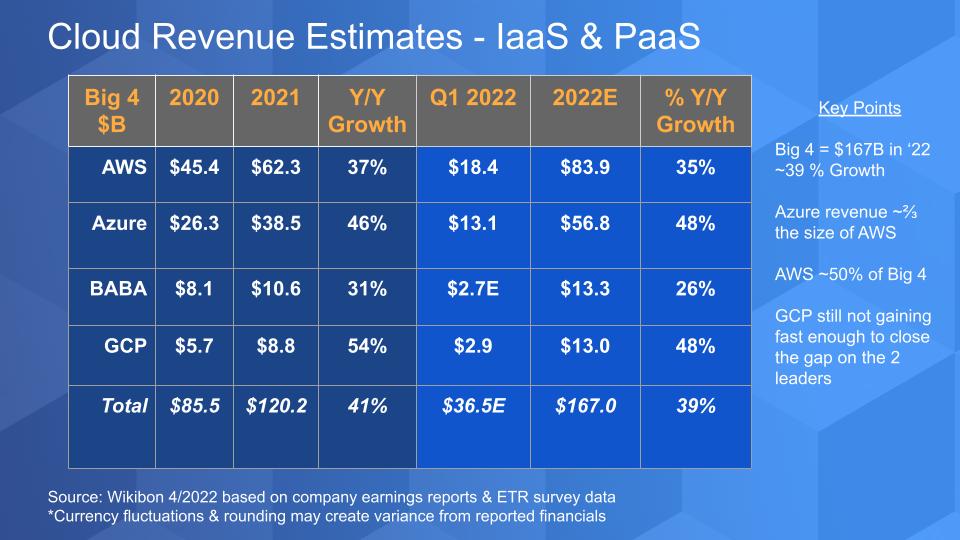

Amazon Internet Solutions Inc., Microsoft Corp. and Alphabet Inc. have all documented earnings and, when you incorporate Alibaba Team Keeping Ltd.’s cloud in the blend, the huge four hyperscalers are on track to produce $167 billion in profits this 12 months based mostly on our projections.

But as we have reported many periods, the definition of cloud is growing. And hybrid environments are starting to be the norm at main corporations. We’re viewing the biggest enterprise tech businesses aim on fixing for hybrid and each and every public cloud business now has a technique to bring their environments nearer to in which customers’ workloads dwell – in information centers and the edge.

In this Breaking Assessment, we’ll update you on our latest cloud projections and outlook. We’ll share the most up-to-date Company Engineering Investigate details and some commentary on what’s occurring in the “hybrid zone” of cloud.

Large 4 hyperscale IaaS and PaaS functionality

In the chart above we share our large 4 cloud shares for infrastructure as a services and system as a company for 2020, 2021, Q1 2022, our estimate for total-calendar year 2022 and relative advancement. Don’t forget, only AWS and Alibaba report fairly thoroughly clean IaaS and PaaS figures, whilst Microsoft and Google bundle their cloud infrastructure in with their program as a services figures. Equally firms, however, give assistance and we use survey data and other tidbits to develop an apples-to-apples comparison.

For the quarter, the significant four approached $37 billion in earnings as a team. Azure’s development amount is documented by Microsoft, but the absolute earnings variety is not. Azure advancement accelerated sequentially by 49% to just over $13 billion in the quarter by our estimates, when AWS’ advancement moderated sequentially but profits nevertheless hit $18.4 billion. Azure is much more than two-thirds the measurement of AWS’ cloud small business. Google Cloud Platform and Alibaba are combating for the bronze medal but nicely powering the two leaders. Microsoft’s Azure acceleration is very impressive for such a massive income base, but it is not unparalleled as we’ve observed this pattern just before with AWS. Nonetheless, the point that Azure is increasing at the very same price as GCP is rather remarkable.

A pair other tidbits: Amazon inventory bought hammered the working day right after it introduced earnings mainly because of inflation and slowing growth costs. But AWS continues to beat Wall Street’s anticipations. A glimpse at Amazon’s operating profits this quarter tells the story. Amazon in general experienced an running reduction of $3.66 billion. AWS’ functioning income was $6.52 billion. AWS’ functioning margin grew sequentially from approximately 30% to 35.3% – an astoundingly financially rewarding determine. This is similar to remarkably successful firms these types of as Oracle Corp. and Microsoft — computer software corporations with application marginal economics. Is that level sustainable? Most likely not, but it’s eye-opening nevertheless.

Breaking down the expending patterns on the major 4

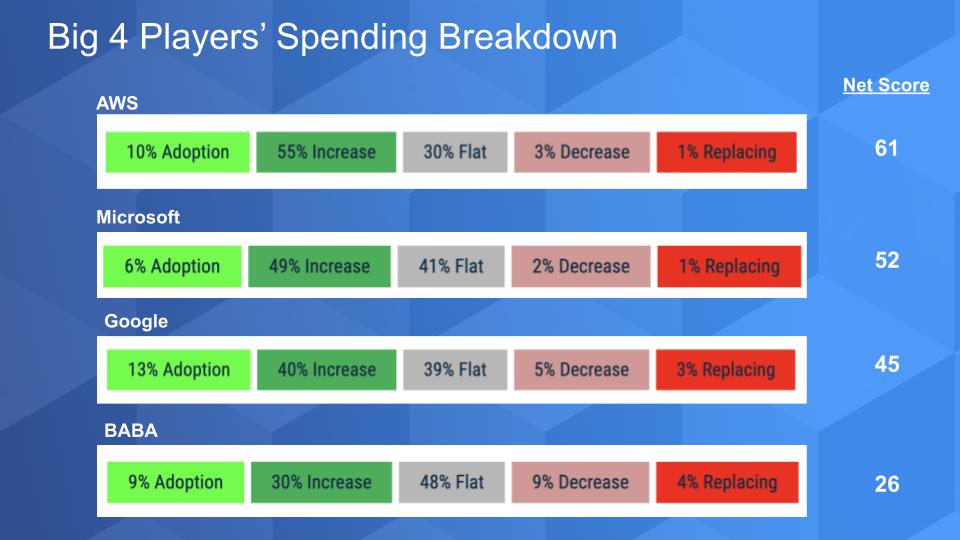

The chart earlier mentioned displays the Internet Rating granularity for the major 4 cloud players. Web Rating actions paying momentum by asking buyers if they’re adopting new – which is the lime environmentally friendly expanding shell out by 6% or more – that is the forest eco-friendly flat spend is the grey shell out dropping by 6% or even worse – which is the light-weight pink and the pink is decommissioning the system. Subtract the reds from the greens and you get a Net Score revealed on the suitable. Anything around 40% is really elevated.

The vital factors right here are as follows: The Microsoft info earlier mentioned contains the company’s entire business enterprise – not just cloud. Its Azure-only Web Rating is 67 — larger than even AWS’. That is massive. Google Cloud, on the other hand, though still elevated, is nicely behind the two leaders. Alibaba’s details sample in the ETR survey is compact and China has had its foot on the neck of significant tech for a whilst, so we can not examine far too a great deal into a Internet Rating of 26.

But observe the replacements in crimson – single digits for all and low single digits for the two giants – 1% – extremely impressive.

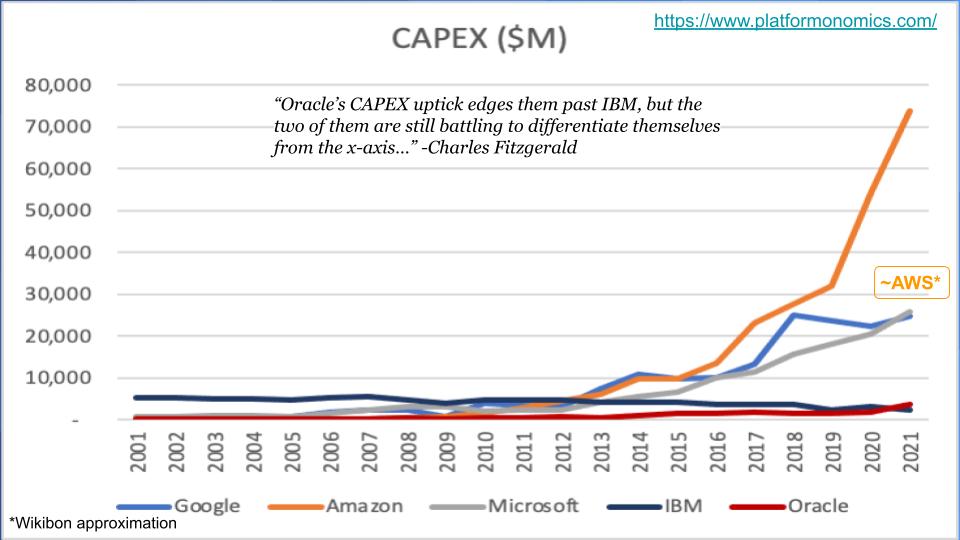

Funds paying tells the story

Capex shell out tends to be a very superior indicator of scale. Charles Fitzgerald, who runs the Plaformonomics blog site, spends a whole lot of time on this topic and we borrowed the chart down below from a new put up – and included some estimates of our personal.

It shows Capex shell out over time for 5 cloud businesses – the massive 3 U.S. corporations furthermore IBM Corp. and Oracle. It’s normally astounding to go back again to the pre-cloud period and appear at IBM. The enterprise was in a terrific place to dominate the transition to as-a-support but could not get its head around cloud and out of its professional companies and outsourcing organizations. IBM is that dim blue or black line. It was outspending Amazon in Capex effectively into the very last 10 years. Exact with R&D spend, by the way.

Charles is a bit of a snark – he loves to make fun of our supercloud principle even while we’re self-confident it is evolving and is true. But his level over is appropriate on. The large a few U.S. players commit significantly a lot more on Capex than IBM and Oracle. He jokes that Oracle’s uptick in Capex expend puts it previous IBM, but the two of them are battling to distance themselves from the X axis. Amusing man.

In its new earnings report, Amazon mentioned that about 40% of its Capex goes to infrastructure and most of that to AWS. It expects Capex to grow this calendar year and close to 50% will go towards infrastructure, so we’ve superimposed our estimate of wherever AWS lands.

Once yet again Microsoft is noteworthy simply because compared with Amazon, it doesn’t have a zillion warehouses to ship goods to individuals. And although Google’s investing is massive, it’s primarily on servers to electrical power its advert community. Of course, GCP can leverage that infrastructure and the tech driving it. And it does.

And so can everyone else leverage all this Capex spend. We’ll occur again to that and talk about supercloud in a moment.

The at any time-increasing cloud landscape

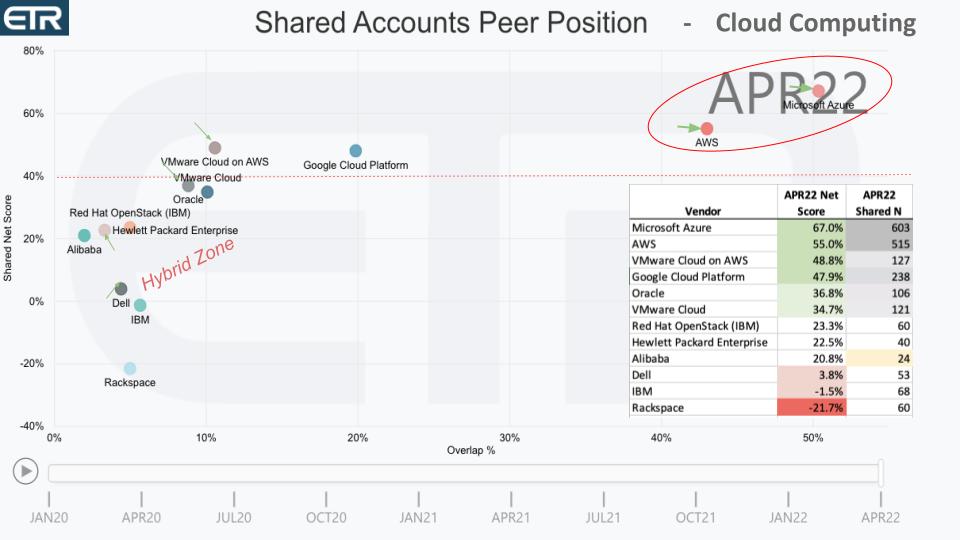

The chart previously mentioned displays a two-dimensional look at of the ETR knowledge for cloud computing. On the vertical axis is Net Rating or paying momentum and on the horizontal axis is pervasiveness in the details set. The X axis is like industry share within the study, if you will. The table insert demonstrates the details for how the dots for just about every vendor are plotted on each axis.

The purple dotted line at 40% implies a highly elevated posture. And the environmentally friendly arrows display the movement for some companies relative to three months back.

Microsoft and AWS are circled in purple way up in the correct hand corner. Pretty extraordinary. Just to cut down muddle, we’re not showing AWS Lambda and some other very elevated services that would force up AWS’ Internet Score. But it’s still actually actually good… as is Azure’s. They’re each transferring solidly to the correct relative to very last quarter’s survey.

Google is very well guiding and has considerably function to do. It was declared this previous 7 days that the head of sales at Google Cloud, Rob Enslin, is leaving to join UiPath Inc… some interesting information there.

We’ve highlighted the “Hybrid Zone.” Now to the topic of this Breaking Examination – the at any time-increasing cloud. AWS introduced that it has done the start of 16 local zones in the U.S. and there are 32 a lot more coming across 26 international locations. Neighborhood Zones basically provide cloud infrastructure to areas exactly where there’s a ton of IT that is not heading to move. And for proximity and latency causes, they have to move closer to the consumers. There’s that Capex buildout coming into participate in all over again.

Now the cause this hybrid zone turns into appealing is you are viewing the big enterprise gamers eventually likely following the hybrid cloud in earnest. It’s practically like the AWS Outposts announcement in 2018 was a wakeup simply call to traditional infrastructure gamers these types of as Dell Systems Inc., Hewlett Packard Enterprise Co. and IBM. Oracle is kind of skipping to its have tune, but it’s in that hybrid zone as well. IBM experienced a good quarter and the Crimson Hat acquisition looks to be functioning to assistance its hybrid cloud approach.

VMware Inc. numerous years in the past cleaned up its fuzzy cloud system and partnered up with all people. And you see above, VMware Cloud on AWS undertaking properly, as is VMware Cloud, its on-premises supplying. Even though it’s rather decreased on the X-axis relative to very last quarter, it’s going to the appropriate with a greater existence in the information set.

Dell and HPE are also attention-grabbing. Equally corporations are likely hard after as-a-services with APEX and GreenLake, respectively. HPE, based mostly on the study information from ETR, looks to have a lead in paying out momentum, even though Dell has a larger sized existence in the study as a a great deal larger firm. HPE is climbing up on the X axis, as is Dell, though not as speedily.

And the place we arrive again to frequently is that the definition of cloud is in the eye of the client. AWS can say, “That’s not cloud.” And the on-prem group can say, “We have cloud much too!” It genuinely does not make any difference. What issues is what the buyer thinks and in which platforms they select to make investments.

That’s why we preserve circling again to the plan of supercloud. You are viewing it evolve and you’re heading to hear more and a lot more about it. It’s possible not the term – lots of really don’t like it – but we’ll continue on to use it as a metaphor for a layer that leverages the Capex reward the large hyperscalers are offering the sector. This is a authentic prospect for the likes of Dell, HPE, IBM, Cisco Devices Inc. and dozens of other providers offering compute and storage infrastructure, networking, security, database and other components of the stack. It is unique to us than multicloud, which is really multivendor– that is, my stack operates on clouds 1, 2 and 3 as a bespoke company.

The chance in our check out is to cover the underlying complexity of the cloud, working with all the software programming interface and primitive muck, building a singular encounter across on-prem, across all the clouds and out to the edge. We see this as a new fight shaping up and new possibilities for startups to aid. It will be costly to create and will have to have ecosystem cooperation throughout the API overall economy to make it a fact. There’s a definite buyer will need for this common experience and in our see we’re observing it manifest in pockets today and in R&D assignments in just each startups and founded gamers.

In our watch, it’s the long term of cloud for any corporation that can’t commit $30 billion a yr on Capex.

Maintain in contact

Thanks to Stephanie Chan, who researched subjects for this Breaking Investigation. Alex Myerson is on creation, the podcasts and media workflows. Particular thanks to Kristen Martin and Cheryl Knight, who support us preserve our local community knowledgeable and get the term out, and to Rob Hof, our editor in main at SiliconANGLE.

Keep in mind we publish every single week on Wikibon and SiliconANGLE. These episodes are all obtainable as podcasts wherever you hear.

Email [email protected], DM @dvellante on Twitter and remark on our LinkedIn posts.

Also, verify out this ETR Tutorial we developed, which clarifies the expending methodology in additional element. Note: ETR is a separate business from Wikibon and SiliconANGLE. If you would like to cite or republish any of the company’s knowledge, or inquire about its services, please get in touch with ETR at [email protected].

Here’s the entire movie assessment:

https://www.youtube.com/view?v=Y7g96HIQQJU

All statements produced regarding organizations or securities are strictly beliefs, points of watch and thoughts held by SiliconANGLE media, Organization Engineering Exploration, other company on theCUBE and guest writers. These statements are not tips by these men and women to purchase, promote or maintain any protection. The content presented does not represent expenditure information and ought to not be utilized as the basis for any investment choice. You and only you are dependable for your investment decisions.