Technology’s impact on modern society and national economies carries on to intensify, in convert rising the organization obligations of technologies service providers and what their customers expect from them.

This further entrenchment in business has also created know-how vendors a great deal more sensitive to factors outside of info technological innovation. It’s no for a longer period sufficient for them to handle client wants and offer high-quality solutions. Fairly, they have to be aware of the broader economic, social and technological forces that have appear to form a huge bearing on their small business.

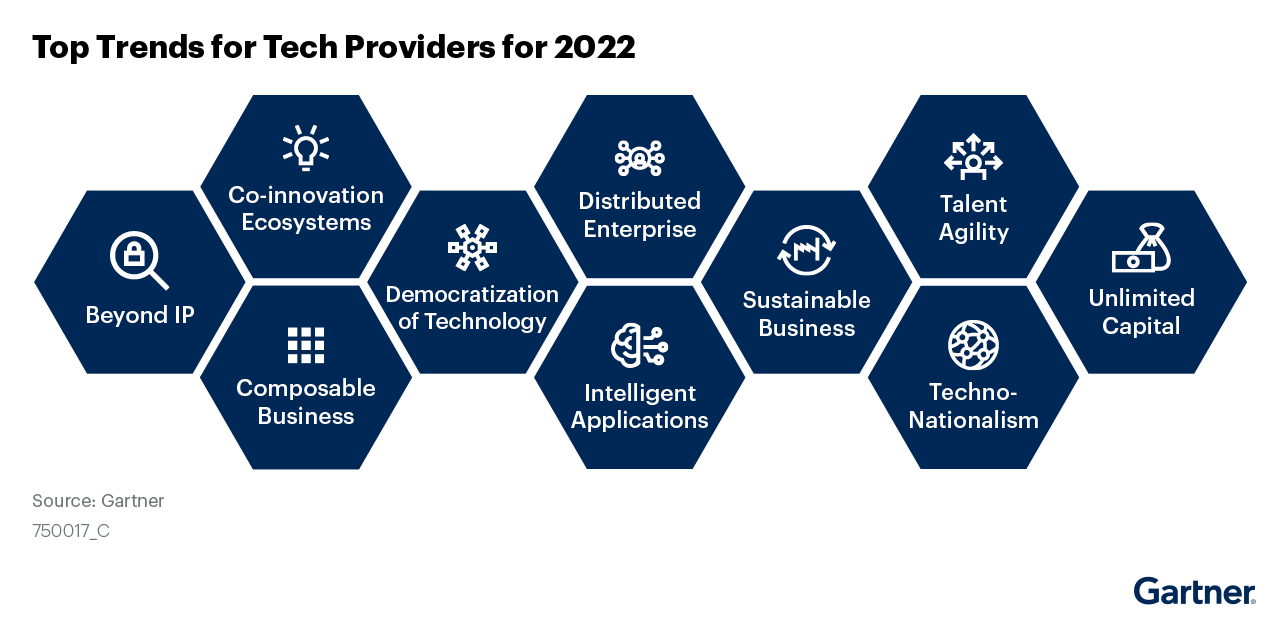

These forces make up this year’s top rated traits for technologies service vendors, or TSPs for brief (below).

Co-innovation ecosystems

Engineering innovation is at the heart of each and every TSP. Nevertheless, in the digital entire world — with significantly more robust interconnections amongst technological innovation suppliers, prospects, companions and governments — traditional siloed innovation practices these kinds of as investigation and development and simple item growth will not be sufficient to survive.

As an alternative, a co-innovation ecosystem is an rising approach that accelerates the improvement of methods to market difficulties, spreads danger and cost throughout the members, and drives adoption of the stop answer. It allows inside, exterior, collaborative and co-resourceful concepts to be converged and straight tied to worth development with the “shared profits/value” among the ecosystem stakeholders and participants.

Engagement, co-development and persuasive ordeals for benefit development are at the core of co-innovation. Product or service development and the value of co-ground breaking businesses are thus challenging to replicate by rivals.

In truth, by 2023, 30% of all revenue-bearing rising engineering options will be created through co-innovation ecosystems, enabling suppliers to grow to be additional competitive and expand into new marketplaces.

Sustainable enterprise

Sustainable company is a tactic that incorporates environmental, social and governance or ESG elements into decision-making. It is underpinned by sustainable know-how, a framework of methods that permit ESG outcomes.

Escalating sustainability-pushed product investments and deployments are having location throughout various classes this kind of as sustainable IT — for instance, cloud sustainability or inexperienced software progress — clever strength infrastructure and round item innovation.

In the conclude, tech companies that can quantify their offering’s constructive contribution to customers’ sustainability objectives will increase their get level by 20% by 2025.

Expertise agility

The write-up-pandemic rate of TSPs’ enterprise can no for a longer time be accommodated by rigid and fragmented expertise administration procedures. This is exactly where expertise agility will come in – the means to support expertise wants for company agility by means of a blend of abilities and talent source assessment, and by connecting fragmented present and new talent swimming pools devoid of borders.

Expertise agility will influence 6 critical locations of TSP enterprise: items and services, prospects and buyers, operations and processes, aggressive landscape, and partners and ecosystems.

By 2025, 30% of TSPs will develop a single talent community to link up to six individual talent swimming pools, up from less than 5% currently.

Techno-nationalism

Electronic sovereignty laws and restrictions are expanding in scope and accelerating in most major marketplaces, providing a shorter-expression window for marketplace enlargement to solidify a presence for TSPs.

As competitors across nation borders and purview declines, and additional restrictive electronic usage regulations increase, selling prices are expected to improve, developing earnings chances for those with scale and access. Governments, way too, will turn into significantly aware of the price of citizen facts.

By 2026, nationalistic and protectionist price-centered economic units will increase 10 periods globally, disrupting a lot more than 80% of all technologies companies’ go-to-market place and product or service techniques. Product leaders will will need special, digitally exclusive functioning architectures that are compliant to social, authorized and economic zones by region.

Democratization of technologies

The democratization of engineering empowers non-IT staff to pick, apply, generate and personalized fit their personal technological innovation. Solution leaders have to embrace the new opportunities this trend provides and meet the wants of a new set of citizen builders and company technologists, or wrestle to provide persuasive solutions and knowledge eroding market place positions.

Soon after all, by 2024, 80% of technologies merchandise and services will be created by people who are not entire-time complex industry experts.

Smart apps

Clever applications use facts and machine discovering to create a constant mastering method that offers adaptive and contextualized experiences. For example, rising intelligent programs could make new money merchandise and expert services centered on client info or generate new buyer experiences these kinds of as autonomous organization operations in retail suppliers or automated workflows and fleets inside of mining.

Business stakeholders intuitively embrace the concepts and guarantees of clever applications, and will only continue to do so. In a latest Gartner finish-user study centered on emerging technological innovation adoption, the necessarily mean investments in intelligent apps about the past 12 months was $408,000, and the indicate value of prepared investments in clever programs inside of 2022 is $618,000.

Dispersed enterprise

Businesses are shifting toward “distributed enterprise” to assistance hybrid work, remote supply and digital experience at all contact details. In this business enterprise design, there is escalating desire for engineering options and tools that can assist a predominantly non-place of work place of work and accelerated digital transformation initiatives to aid dispersed supply for customers.

Tech companies must respond to these shifts by prioritizing technologies and product or service abilities that blend the digital and actual physical worlds. By 2023, 75% of corporations that exploit dispersed organization advantages will know profits expansion 25% more rapidly than opponents.

Composable business enterprise

Composable business is a thought the place leaders can immediately construct new business capabilities by assembling digital property in an firm that is architected for true-time adaptability and resilience in the facial area of uncertainty. It impacts all aspects of tech providers’ organization as it enables enterprises capability to respond to the current market and seize electronic opportunities speedier and more affordable.

Seven p.c of respondents in the 2022 Gartner CIO and Technologies Govt Survey indicated that they have already invested in composable organization, but an added 60% assume to have finished so by the stop of a few years.

Composable small business is certainly a market change but does open up up new markets for TSPs.

Further than intellectual house

Historically, preserving and managing strategies and innovations equaled edge. IP strategies these as patents represented a highly effective way of creating price and are the cornerstone of standard superior-tech strategies. But their part is altering.

“Beyond IP” recognizes the rise of alternate techniques for acknowledging worth from tips, inventions and other proprietary assets. Alternatively than creating proprietary IPs with finite boundaries to be defended, new leaders seek out a pool of suggestions and perception with fluid boundaries whose price raises via software that builds the upcoming set of suggestions.

IP and mental cash or IP/IC security approaches dependent on “fixing ideas” into patents and so forth will minimize the worth of the IP/IC by up to 50% around the next five a long time.

Unrestricted capital

Unlimited money is the trend in which there is these types of an abundance of money competing for expense in non-public firms, that tech companies have entry to almost unrestricted quantities of money at a very low price tag. Startups that can properly demonstrate products marketplace suit can raise drastically much larger rounds of financing at earlier levels of development, enabling them to speed up development without having regard to cash performance or risk.

Rajesh Kandaswamy (@rajeshakan) is a distinguished analyst vice president and fellow at Gartner Inc. who advises C-degree executives and product or service leaders on the strategic impression of rising technologies. He wrote this post for SiliconANGLE. Be part of Rajesh and his colleagues at the Tech Growth & Innovation Conference, getting position virtually July 12-13, 2022.